Question: The answer I put for the first question was a quess and needs to be solved as well. Thanks! w Required information Financial results were

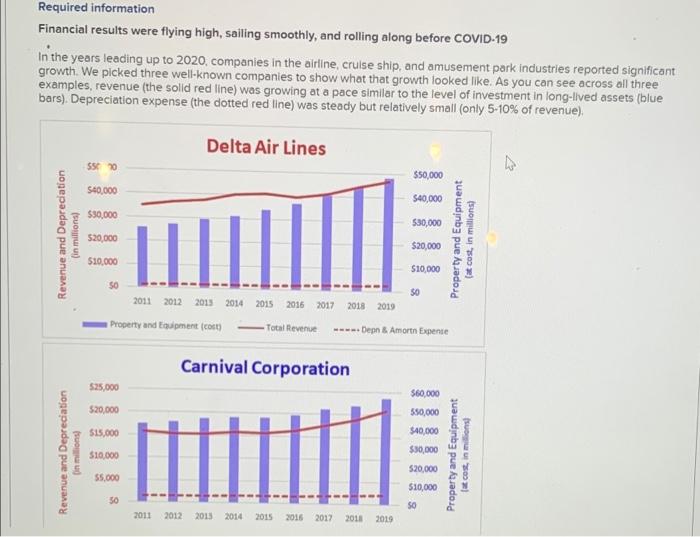

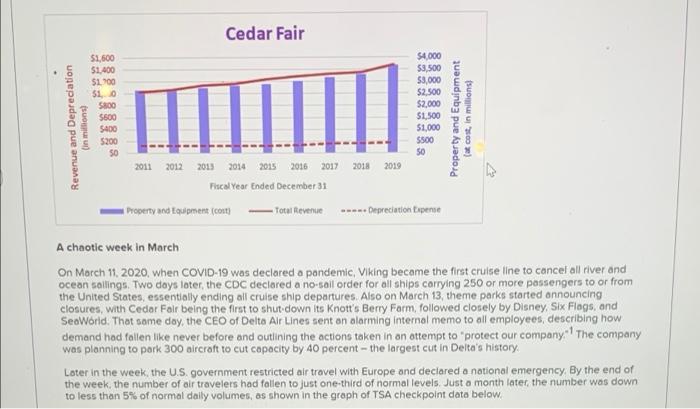

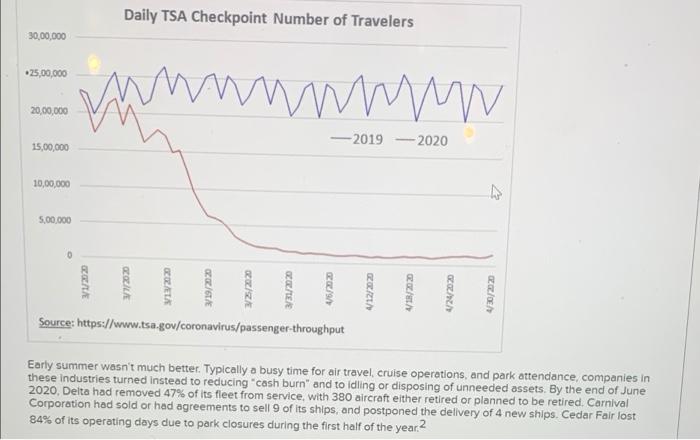

w Required information Financial results were flying high, sailing smoothly, and rolling along before COVID-19 In the years leading up to 2020, companies in the airline, cruise ship, and amusement park industries reported significant growth. We picked three well-known companies to show what that growth looked like. As you can see across all three examples, revenue (the solid red line) was growing at a pace similar to the level of investment in long-lived assets (blue bars). Depreciation expense (the dotted red line) was steady but relatively small (only 5-10% of revenue), Delta Air Lines $ 50 $50,000 $40,000 $40,000 $30,000 530,000 Revenue and Depreciation (in millions) 520,000 Property and Equipment (at cost, in millions) LII . $20,000 $10.000 $10,000 50 50 2015 2011 2012 2013 2014 Property and Equipment for 2016 2017 2018 2019 ----Dep 8. Amor Expense Total Revenue Carnival Corporation $25,000 560.000 $20,000 550,000 515,000 $40,000 Revenue and Depreciation Din millions $30,000 $10.000 Property and Equipment 520.000 55.000 $10,000 50 50 2011 2012 2015 2014 2015 2016 2017 2011 2019 Revenue and Depreciation in millions) Cedar Fair $1,500 $4.000 $1.400 $3.500 $1900 $3,000 $1.0 $2.500 5800 $2,000 5600 $1,500 $400 51,000 5200 5500 50 50 2011 2012 2013 2014 2015 2016 2017 2018 2019 Fiscal Year Ended December 31 Property and Equipment (com) Total Revenue Depreciation Expense Property and Equipment (at cost in millions A chaotic week in March On March 11, 2020, when COVID-19 was declared a pandemie, Viking became the first cruise line to cancel all river and ocean salings. Two days later, the CDC declared a no soil order for all ships carrying 250 or more passengers to or from the United States, essentially ending all cruise ship departures. Also on March 13, theme parke started announcing closures, with Cedar For being the first to shut down its Knott's Berry Farm, followed closely by Disney, Six Flags and SeaWorld. That some day, the CEO of Delta Air Lines sent on olarming internal memo to all employees, describing how demand had fallen like never before and outlining the actions taken in an attempt to protect our company. The company was planning to park 300 aircraft to cut capacity by 40 percent - the largest cut in Delta's history Later in the week, the US government restricted air travel with Europe and declared a national emergency By the end of the week, the number of air travelers had fallen to just one-third of normal levels. Just a month later the number was down to less than 5% of normal daily volumes, as shown in the graph of TSA checkpoint dato below. Daily TSA Checkpoint Number of Travelers 30,00,000 25,00,000 wwwwwww 20,00,000 -2019 -2020 15,00,000 10,00,000 5,00,000 COR COLETA 2/ 23/2020 BOTE 06/2020 ORA VIR/2020 V24/2020 4/30/2020 Source: https://www.tsa.gov/coronavirus/passenger-throughput Early summer wasn't much better. Typically a busy time for air travel, cruise operations, and park attendance companies in these industries turned instead to reducing cash burn" and to Idling or disposing of unneeded assets. By the end of June 2020, Delta had removed 47% of its fleet from service, with 380 aircraft either retired or planned to be retired. Carnival Corporation had sold or had agreements to sell 9 of its ships, and postponed the delivery of 4 new ships. Cedar Fair lost 84% of its operating days due to park closures during the first half of the year 2 Total Revenue 2020 2019 436 The financial impact (in millions) Company (ouarterly period) Delta Air Ines (April - June) $ 1,468 $ 12,536 'Carnival Corporation (June - August) 31 6,533 Cedar Fair (April - June) 7 Source: Form 10-0 quarterly filings at sec.gov. The revenue impact of such a dramatic shutdown on our three companies was striking The table above shows total revenue for three-month periods ending June 30 (Delta and Cedar For) or August 31 (Carnival). All three companies' total revenue plummeted, Delta faired the best, with its quarterly revenue from April to June 2020 being 11.7% of what was reported for the same period in 2019. In early summer 2020, Cedar Fair generated only $7 million (1.6% of its 2019 number) and Carnival reported less than half a percent of its prior year summer revenue. Yet, despite so many of their long-lived assets being idle during this time, the companies depreciation expense (shown below) was largely unchanged from the amounts reported for the same period in the previous year. Only Delta had a sizable decline (17%), as a result of having already committed to retire 383 aircraft Depreciation Company (Quarterly period) (in millions) Expense 2020 2010 Delta Air Lines (April - June) $ 591 $713 Carnival Corporation (June - August) 548 Cedar Fair (April - June) 55 Source: for 100 quarterly filings at sec.gov. What do US GAAP and IFRS say about depreciation for Idled assets? Depreciation methods are based on either time or usage. When using time-based methods, depreciation is reported as time goes by, even if a long-lived asset has been temporarily Idled. The only exceptions are when: (1) the asset reaches the end of its useful life, (l) the company commits to a plan to abandon the asset, or (lt) the asset is held for sale 3 Depreciation based on usage, on the other hand, is zero whenever the asset is idled. Accounting standards are clear that companies should consider revising their depreciation methods (and estimated useful lives) whenever an adverse change affects the way their long-lived assets are being used. But to our knowledge, only two companies did so during the COVID-19 pandemic: Southern China Airlines and Air Chino.5 551 Wi ch depreciation method is depicted by the dotted red lines in the graphs? Multiple Choice First-in, first-out Straight-line. Units-of-production Declining balance Which of the following accurately explains why the dotted red lines in the graph (representing depreciation expense) sloped slightly upward from 2011 to 2019? Multiple Choice Straight line depreciation designed to produce slightly more expense each year Depreciation experten matched to revenues revenus resto todos deprecation lach you accomodated depreciation is added to deprecmon apena, yolding a slightly lige amount of depreciation were The movie in one was greach year to the amount of deprescono will be no change in der

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts