Question: the answer in there is wrong 3 A sporting goods manufacturer has decided to expand into a related business. Management estimates that to build and

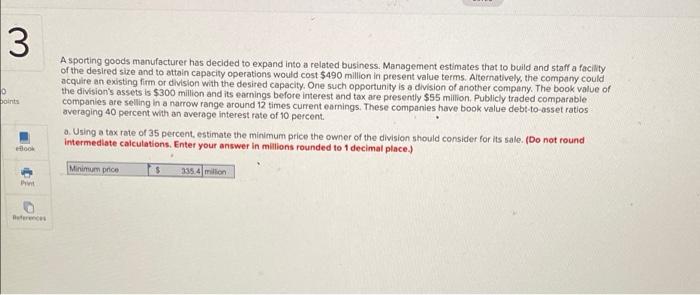

3 A sporting goods manufacturer has decided to expand into a related business. Management estimates that to build and staff a facility of the desired size and to attain capacity operations would cost $490 million in present value terms. Alternatively, the company could acquire an existing firm or division with the desired capacity. One such opportunity is a division of another company. The book value of the division's assets is $300 million and its earnings before interest and tax are presently $55 million. Publicly traded comparable companies are selling in a narrow range around 12 times current earnings. These companies have book value debt-to-asset ratios averaging 40 percent with an average interest rate of 10 percent. a. Using a tax rate of 35 percent, estimate the minimum price the owner of the division should consider for its sale. (Do not round intermediate calculations. Enter your answer in millions rounded to 1 decimal place.) eBook Minimum price 335.4 million Pint References points

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts