Question: The answer is 116250. How do we get to 116250? Consider bidding for a project to supply 85 million postage stamps per year to USPS

The answer is 116250. How do we get to 116250?

The answer is 116250. How do we get to 116250?

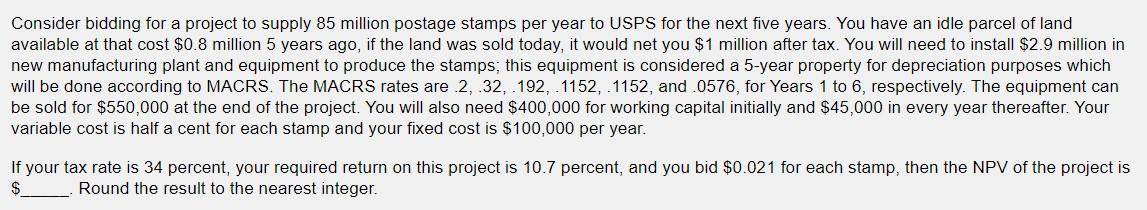

Consider bidding for a project to supply 85 million postage stamps per year to USPS for the next five years. You have an idle parcel of land available at that cost $0.8 million 5 years ago, if the land was sold today, it would net you $1 million after tax. You will need to install $2.9 million in new manufacturing plant and equipment to produce the stamps; this equipment is considered a 5-year property for depreciation purposes which will be done according to MACRS. The MACRS rates are 2, 32, 192, 1152, 1152, and .0576, for Years 1 to 6, respectively. The equipment can be sold for $550,000 at the end of the project. You will also need $400,000 for working capital initially and $45,000 in every year thereafter. Your variable cost is half a cent for each stamp and your fixed cost is $100,000 per year. If your tax rate is 34 percent, your required return on this project is 10.7 percent, and you bid $0.021 for each stamp, then the NPV of the project is $ Round the result to the nearest integer. Consider bidding for a project to supply 85 million postage stamps per year to USPS for the next five years. You have an idle parcel of land available at that cost $0.8 million 5 years ago, if the land was sold today, it would net you $1 million after tax. You will need to install $2.9 million in new manufacturing plant and equipment to produce the stamps; this equipment is considered a 5-year property for depreciation purposes which will be done according to MACRS. The MACRS rates are 2, 32, 192, 1152, 1152, and .0576, for Years 1 to 6, respectively. The equipment can be sold for $550,000 at the end of the project. You will also need $400,000 for working capital initially and $45,000 in every year thereafter. Your variable cost is half a cent for each stamp and your fixed cost is $100,000 per year. If your tax rate is 34 percent, your required return on this project is 10.7 percent, and you bid $0.021 for each stamp, then the NPV of the project is $ Round the result to the nearest integer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts