Question: The answer is #5 is C and #6 is D Here is a decision tree: Figure 3-5 Decision Tree for Timing a New Product Offering

The answer is #5 is C and #6 is D

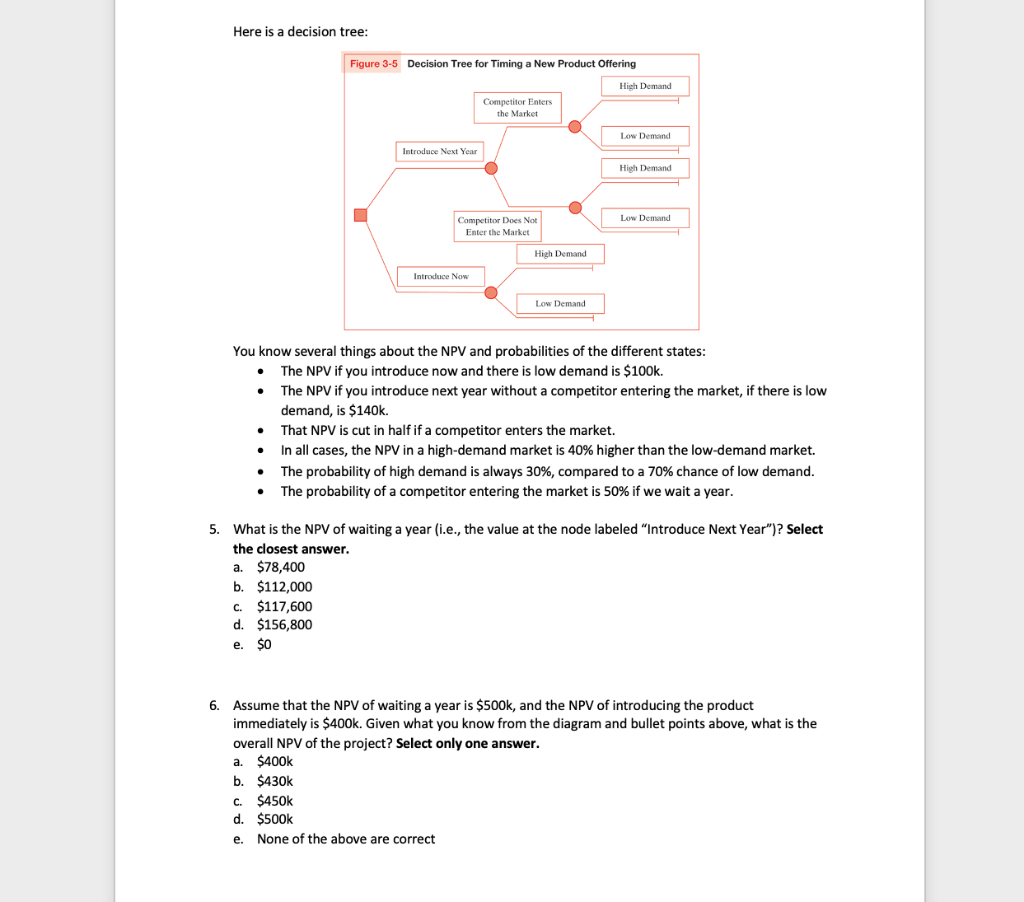

Here is a decision tree: Figure 3-5 Decision Tree for Timing a New Product Offering High Demand Competitor Enters the Market Low Demand Introduce Next Year High Demand Low Demand Competitor Does Nos Enter the Market High Demand Introduce Now Low Demand You know several things about the NPV and probabilities of the different states: The NPV if you introduce now and there is low demand is $100k. The NPV if you introduce next year without a competitor entering the market, if there is low demand, is $140k. That NPV is cut in half if a competitor enters the market. In all cases, the NPV in a high-demand market is 40% higher than the low-demand market. The probability of high demand is always 30%, compared to a 70% chance of low demand. The probability of a competitor entering the market is 50% if we wait a year. . 5. What is the NPV of waiting a year (i.e., the value at the node labeled "Introduce Next Year")? Select the closest answer. a. $78,400 b. $112,000 C. $117,600 d. $156,800 e. $0 6. Assume that the NPV of waiting a year is $500k, and the NPV of introducing the product immediately is $400k. Given what you know from the diagram and bullet points above, what is the overall NPV of the project? Select only one answer. a $400K b. $430k C. $450k d. $500k None of the above are correct e

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts