Question: The answer is $6,000 How do you get this answer. 12A-24 A newly hired engineer signed up for the 401k plan at her new job.

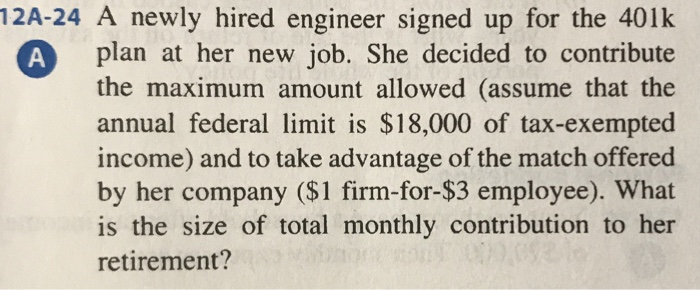

12A-24 A newly hired engineer signed up for the 401k plan at her new job. She decided to contribute the maximum amount allowed (assume that the annual federal limit is $18,000 of tax-exempted income) and to take advantage of the match offered by her company ($1 firm-for-$3 employee). What is the size of total monthly contribution to her retirement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts