Question: The answer is B. How to get the answer? The answer is D. How to get the answer? Simmons Inc. has an expected net income

The answer is B. How to get the answer?

The answer is B. How to get the answer?

The answer is D. How to get the answer?

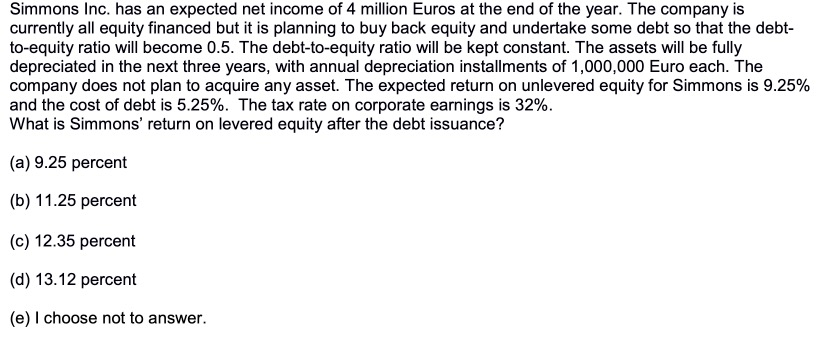

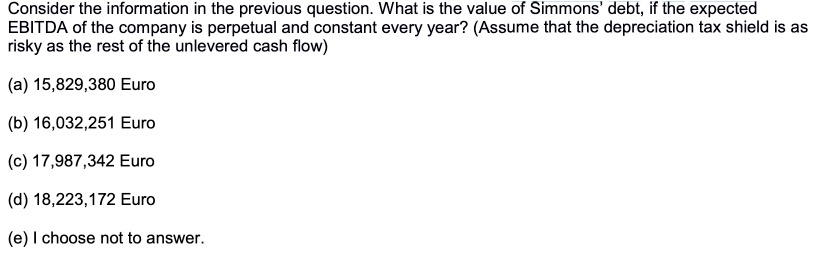

Simmons Inc. has an expected net income of 4 million Euros at the end of the year. The company is currently all equity financed but it is planning to buy back equity and undertake some debt so that the debt- to-equity ratio will become 0.5. The debt-to-equity ratio will be kept constant. The assets will be fully depreciated in the next three years, with annual depreciation installments of 1,000,000 Euro each. The company does not plan to acquire any asset. The expected return on unlevered equity for Simmons is 9.25% and the cost of debt is 5.25%. The tax rate on corporate earnings is 32% What is Simmons' return on levered equity after the debt issuance? (a) 9.25 percent (b) 11.25 percent (c) 12.35 percent (d) 13.12 percent (e) I choose not to answer. Consider the information in the previous question. What is the value of Simmons' debt, if the expected EBITDA of the company is perpetual and constant every year? (Assume that the depreciation tax shield is as risky as the rest of the unlevered cash flow) (a) 15,829,380 Euro (b) 16,032,251 Euro (c) 17,987,342 Euro (d) 18,223,172 Euro (e) I choose not to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts