Question: the answer is below, please write down the process as detailed as possible, thanks 2. Assume a standard OLG model that is modified to include

the answer is below, please write down the process as detailed as possible, thanks

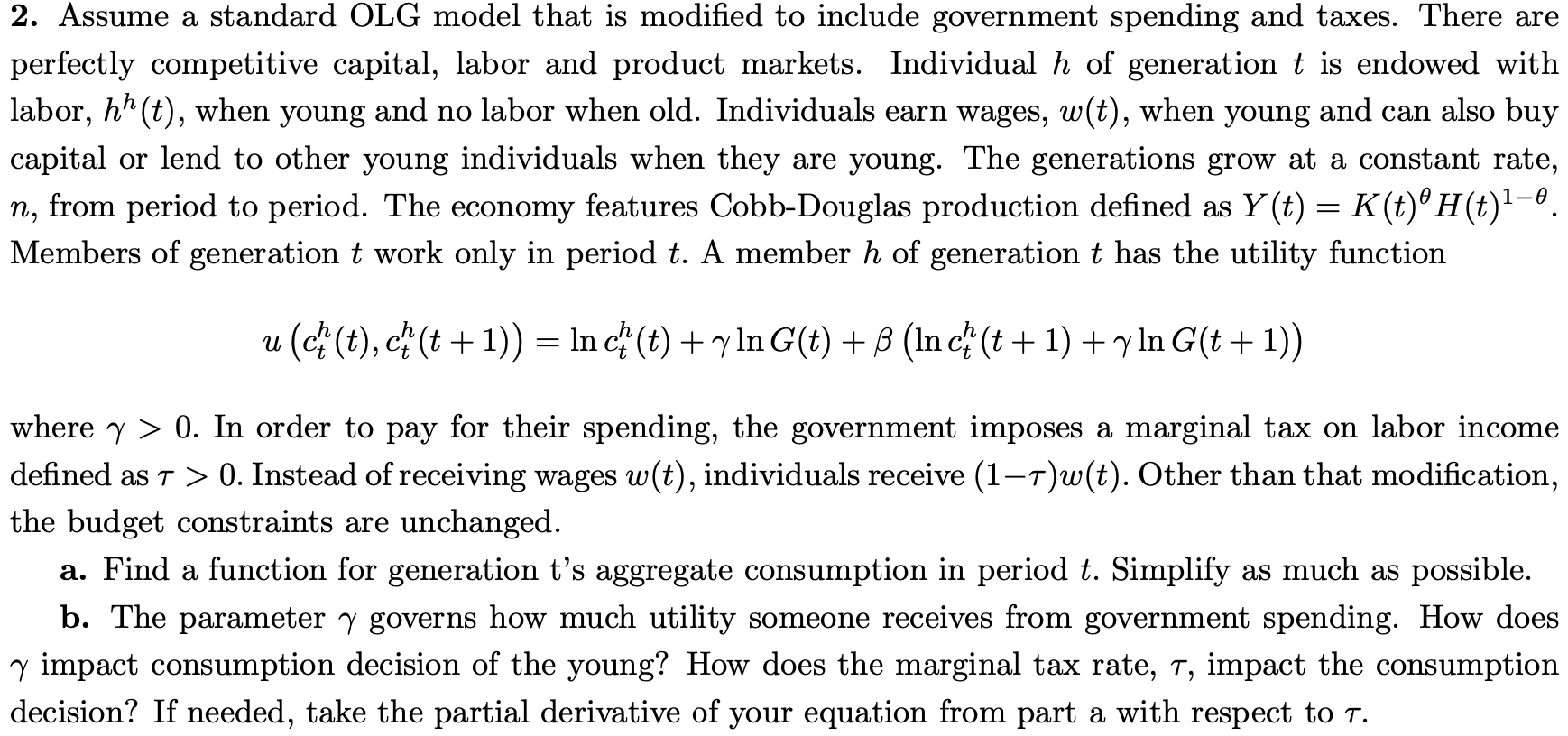

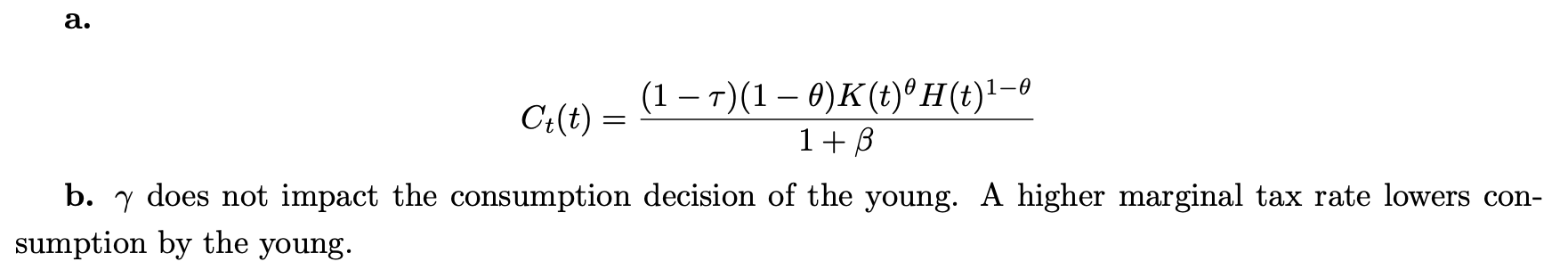

2. Assume a standard OLG model that is modified to include government spending and taxes. There are perfectly competitive capital, labor and product markets. Individual h of generation t is endowed with labor, hh(t), when young and no labor when old. Individuals earn wages, w(t), when young and can also buy capital or lend to other young individuals when they are young. The generations grow at a constant rate, n, from period to period. The economy features Cobb-Douglas production defined as Y(t)=K(t)H(t)1. Members of generation t work only in period t. A member h of generation t has the utility function u(cth(t),cth(t+1))=lncth(t)+lnG(t)+(lncth(t+1)+lnG(t+1)) where >0. In order to pay for their spending, the government imposes a marginal tax on labor income defined as >0. Instead of receiving wages w(t), individuals receive (1)w(t). Other than that modification, the budget constraints are unchanged. a. Find a function for generation t's aggregate consumption in period t. Simplify as much as possible. b. The parameter governs how much utility someone receives from government spending. How does impact consumption decision of the young? How does the marginal tax rate, , impact the consumption decision? If needed, take the partial derivative of your equation from part a with respect to . Ct(t)=1+(1)(1)K(t)H(t)1 b. does not impact the consumption decision of the young. A higher marginal tax rate lowers consumption by the young

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts