Question: the answer is c but how do you get this answer? 25. Great River County's budget calls for total estimated revenues of $7,900,000 for the

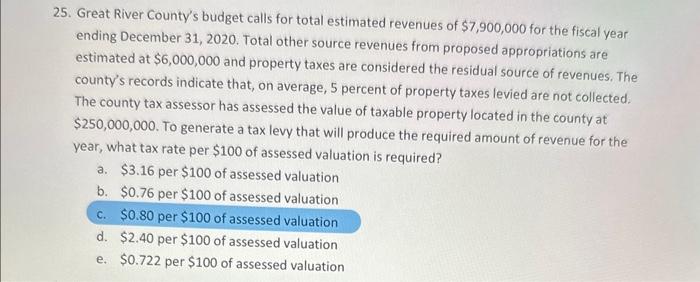

25. Great River County's budget calls for total estimated revenues of $7,900,000 for the fiscal year ending December 31,2020 . Total other source revenues from proposed appropriations are estimated at $6,000,000 and property taxes are considered the residual source of revenues. The county's records indicate that, on average, 5 percent of property taxes levied are not collected. The county tax assessor has assessed the value of taxable property located in the county at $250,000,000. To generate a tax levy that will produce the required amount of revenue for the year, what tax rate per $100 of assessed valuation is required? a. $3.16 per $100 of assessed valuation b. $0.76 per $100 of assessed valuation c. $0.80 per $100 of assessed valuation d. $2.40 per $100 of assessed valuation e. $0.722 per $100 of assessed valuation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts