Question: The answer is C but i do not know how to make a decision tree or hwo to do this problem. Can you help? Preferably

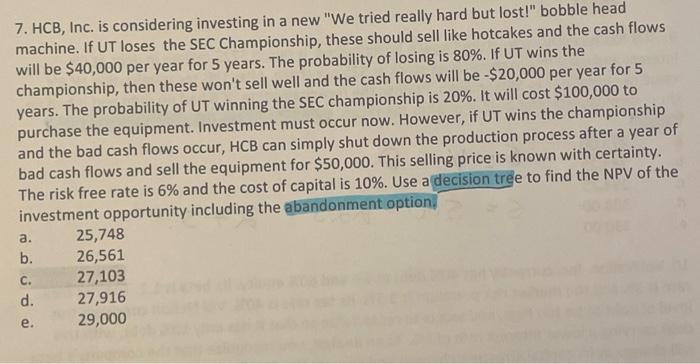

7. HCB, Inc. is considering investing in a new "We tried really hard but lost!" bobble head machine. If UT loses the SEC Championship, these should sell like hotcakes and the cash flows will be $40,000 per year for 5 years. The probability of losing is 80%. If UT wins the championship, then these won't sell well and the cash flows will be -$20,000 per year for 5 years. The probability of UT winning the SEC championship is 20%. It will cost $100,000 to purchase the equipment. Investment must occur now. However, if UT wins the championship and the bad cash flows occur, HCB can simply shut down the production process after a year of bad cash flows and sell the equipment for $50,000. This selling price is known with certainty. The risk free rate is 6% and the cost of capital is 10%. Use a decision tree to find the NPV of the investment opportunity including the abandonment option 25,748 b. 26,561 27,103 d. 27,916 29,000 a. C. e. 7. HCB, Inc. is considering investing in a new "We tried really hard but lost!" bobble head machine. If UT loses the SEC Championship, these should sell like hotcakes and the cash flows will be $40,000 per year for 5 years. The probability of losing is 80%. If UT wins the championship, then these won't sell well and the cash flows will be -$20,000 per year for 5 years. The probability of UT winning the SEC championship is 20%. It will cost $100,000 to purchase the equipment. Investment must occur now. However, if UT wins the championship and the bad cash flows occur, HCB can simply shut down the production process after a year of bad cash flows and sell the equipment for $50,000. This selling price is known with certainty. The risk free rate is 6% and the cost of capital is 10%. Use a decision tree to find the NPV of the investment opportunity including the abandonment option 25,748 b. 26,561 27,103 d. 27,916 29,000 a. C. e

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts