Question: the answer is C if you could help me work it out. Analysts predict that Burks Corporation will have free cash flows (FCFS) of negative

the answer is C if you could help me work it out.

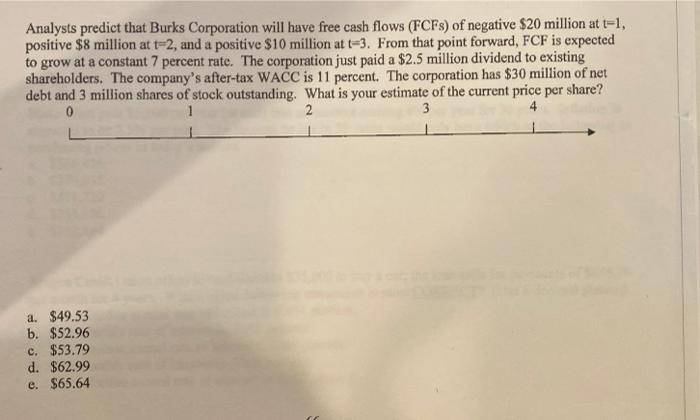

the answer is C if you could help me work it out. Analysts predict that Burks Corporation will have free cash flows (FCFS) of negative $20 million at t-1, positive $8 million at t-2, and a positive $10 million at t=3. From that point forward, FCF is expected to grow at a constant 7 percent rate. The corporation just paid a $2.5 million dividend to existing shareholders. The company's after-tax WACC is 11 percent. The corporation has $30 million of net debt and 3 million shares of stock outstanding. What is your estimate of the current price per share? 0 2 3 4 a. $49.53 b. $52.96 c. $53.79 d. $62.99 e. $65.64

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts