Question: the answer is given, but I do not understand what (st-k,0) and (0,k-st) from, and what are they. help me please 18. A short forward

the answer is given, but

I do not understand what (st-k,0) and (0,k-st) from, and what are they. help me please

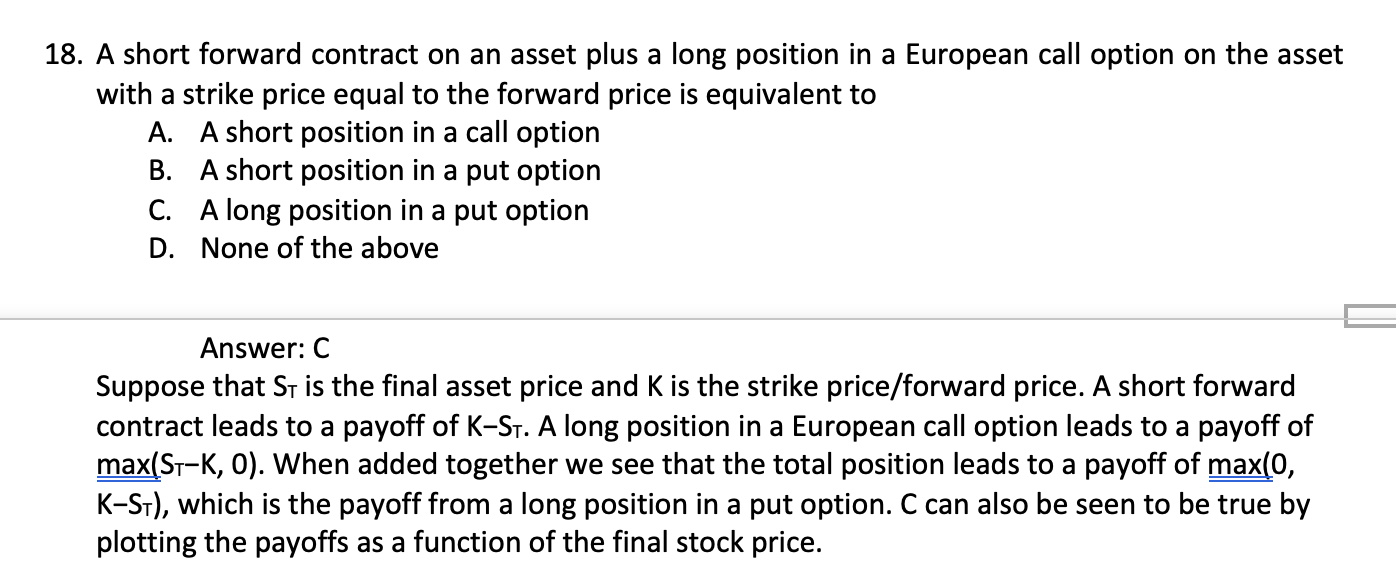

18. A short forward contract on an asset plus a long position in a European call option on the asset with a strike price equal to the forward price is equivalent to A. A short position in a call option B. A short position in a put option C. A long position in a put option D. None of the above Answer: C Suppose that St is the final asset price and K is the strike price/forward price. A short forward contract leads to a payoff of K-St. A long position in a European call option leads to a payoff of max(ST-K, O). When added together we see that the total position leads to a payoff of max(0, K-St), which is the payoff from a long position in a put option. C can also be seen to be true by plotting the payoffs as a function of the final stock price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts