Question: THE ANSWER IS NOT $ 110,00. Can you please walk through the steps to find the correct answer? Pink Corporation acquired land and securities in

THE ANSWER IS NOT $110,00. Can you please walk through the steps to find the correct answer?

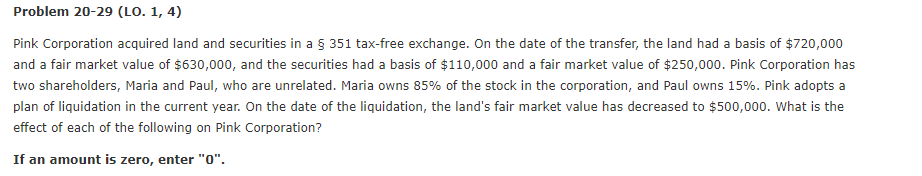

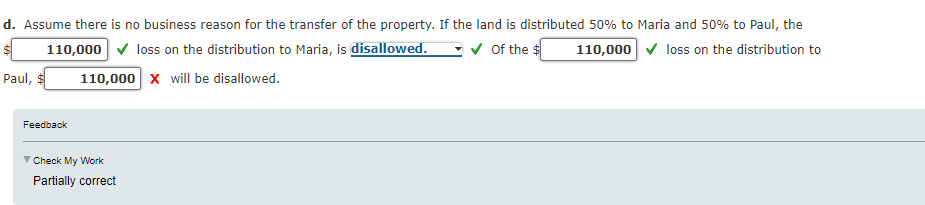

Pink Corporation acquired land and securities in a 351 tax-free exchange. On the date of the transfer, the land had a basis of $720,000 and a fair market value of $630,000, and the securities had a basis of $110,000 and a fair market value of $250,000. Pink Corporation has two shareholders, Maria and Paul, who are unrelated. Maria owns 85% of the stock in the corporation, and Paul owns 15%. Pink adopts a plan of liquidation in the current year. On the date of the liquidation, the land's fair market value has decreased to $500,000. What is the effect of each of the following on Pink Corporation? If an amount is zero, enter " 0 ". Assume there is no business reason for the transfer of the property. If the land is distributed 50% to Maria and 50% to Paul, the loss on the distribution to Maria, is ? Of the loss on the distribution to X will be disallowed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts