Question: the answer is not either 52,000 or 20,000 so please i will dislike if the answer is a wrong answer At the end of the

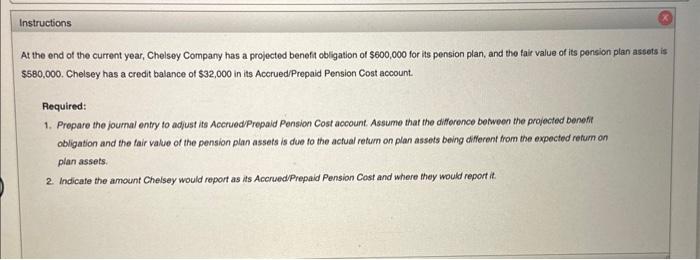

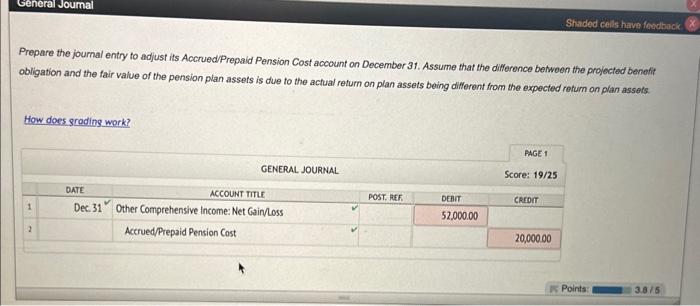

At the end of the current year, Chelsey Company has a projected benefit obligation of $600,000 for its pension plan, and the fair value of its pension plan astets is $580,000. Chelsey has a credit balance of $32,000 in its AccruedPrepaid Pension Cost account. Pequired: 1. Propare the joumal entry to adjust its AccruedPropaid Pension Cost account Assume that the difforence bomeon the projocted benefit obligation and the fair value of the pension plan assets is due to the actual return on plan assots being difleront from the expected retum on plan assets. 2. Indicafe the amount Chelsey would report as its Accrwedprepaid Pension Cost and where they would report it. Prepare the joumal entry to adjust its Accrued/Prepaid Pension Cost account on December 31. Assume that the diflerence behwoen the projectod benefit obligation and the fair value of the pension plan assets is due to the actual retum on plan assets being different from the expected retum on plan assets. How does groding work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts