Question: The answer is not those two!!!!!!!!! The answer is not those two!!!!!!!!! The answer is not those two!!!!!!!!! The answer is not those two!!!!!!!!! The

The answer is not those two!!!!!!!!!

The answer is not those two!!!!!!!!!

The answer is not those two!!!!!!!!!

The answer is not those two!!!!!!!!!

The answer is not those two!!!!!!!!!

The answer is not those two!!!!!!!!!

The answer is not those two!!!!!!!!!

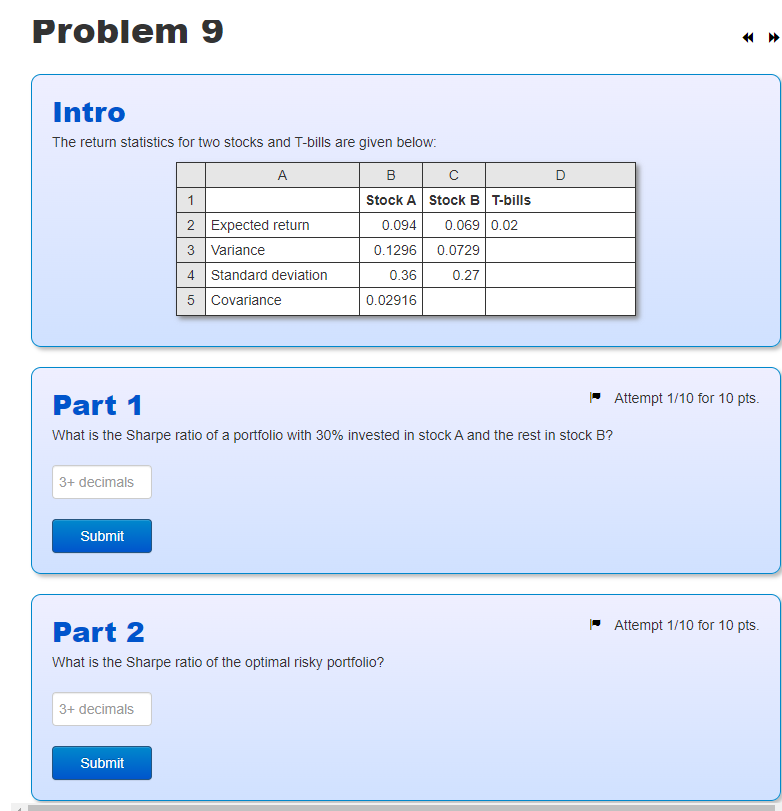

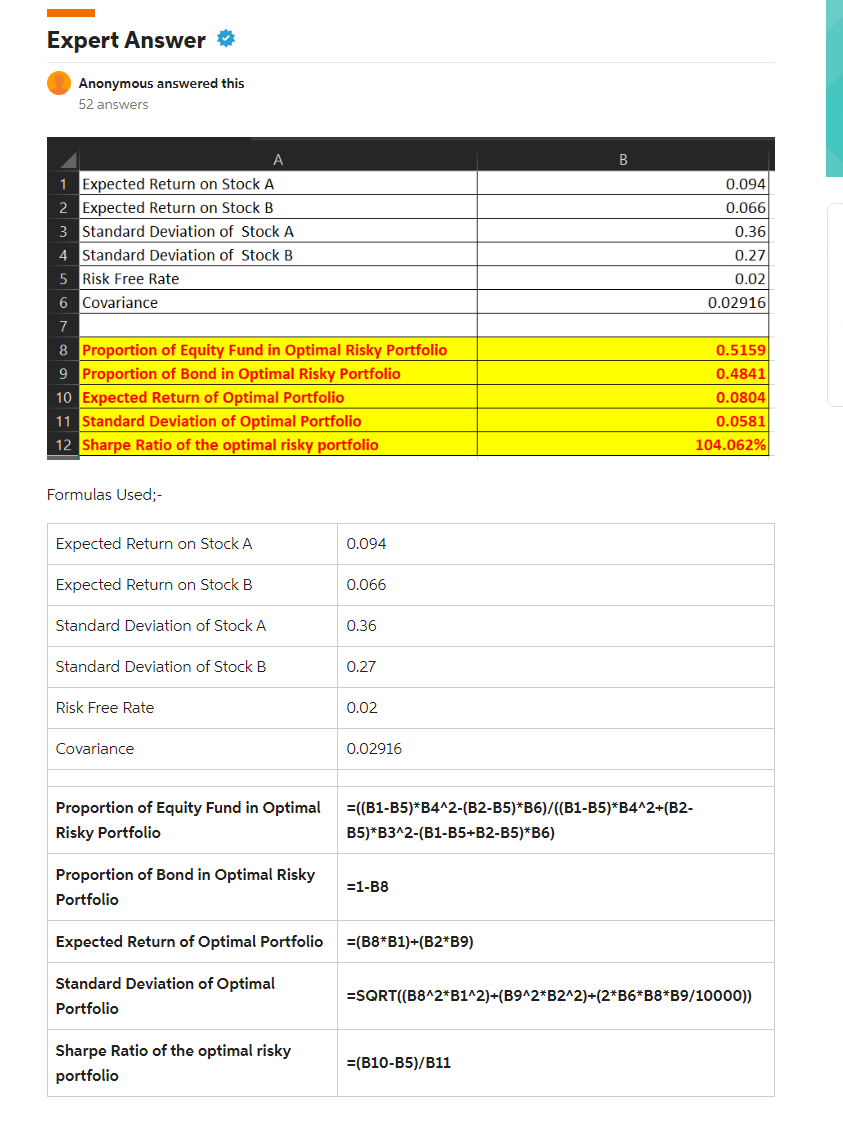

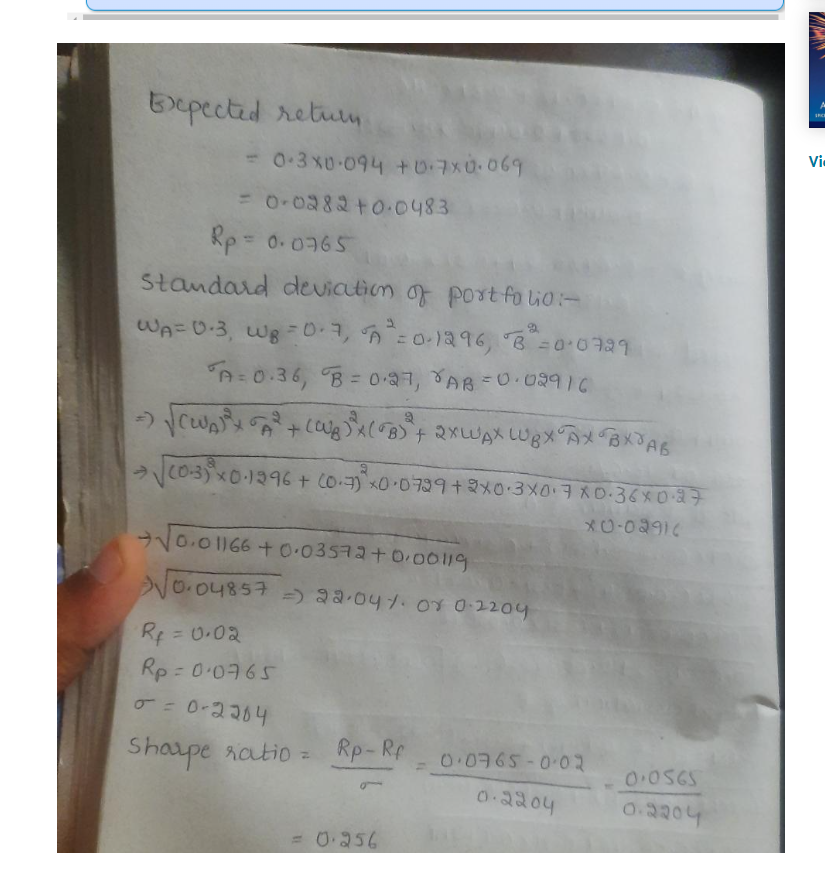

Problem 9 D Intro The return statistics for two stocks and T-bills are given below: A B 1 Stock A Stock B T-bills 2 Expected return 0.094 0.069 0.02 3 Variance 0.1296 0.0729 4 Standard deviation 0.36 0.27 5 Covariance 0.02916 Part 1 Attempt 1/10 for 10 pts. What is the Sharpe ratio of a portfolio with 30% invested in stock A and the rest in stock B? 3+ decimals Submit Attempt 1/10 for 10 pts. Part 2 What is the Sharpe ratio of the optimal risky portfolio? 3+ decimals Submit Expert Answer Anonymous answered this 52 answers B 0.094 0.066 0.36 0.27 0.02 0.02916 1 Expected Return on Stock A 2 Expected Return on Stock B 3 Standard Deviation of Stock A 4 Standard Deviation of Stock B 5 Risk Free Rate 6 Covariance 7 8 Proportion of Equity Fund in Optimal Risky Portfolio 9 Proportion of Bond in Optimal Risky Portfolio 10 Expected Return of Optimal Portfolio 11 Standard Deviation of Optimal Portfolio 12 Sharpe Ratio of the optimal risky portfolio 0.5159 0.4841 0.0804 0.0581 104.062% Formulas Used: - Expected Return on Stock A 0.094 Expected Return on Stock B 0.066 Standard Deviation of Stock A 0.36 Standard Deviation of Stock B 0.27 Risk Free Rate 0.02 Covariance 0.02916 Proportion of Equity Fund in Optimal Risky Portfolio =((B1-B5)*B4^2-(B2-B5)*B6)/((B1-B5)*B4^2+(B2- B5)*B3^2-(B1-B5-B2-B5)*86) Bond in Optimal Risky Proportion Portfolio =1-B8 Expected Return of Optimal Portfolio =(B8*B1)+(B2*B9) Standard Deviation of Optimal Portfolio =SQRT((B8^2*B1^2)+(B9^2*B2^2)+(2*B6*B8*B9/10000)) Sharpe Ratio of the optimal risky portfolio =(B10-B5)/B11 Vic Bepected return - 0.3x0.094 +0.7% 0.069. = 0.0282 +0.0483 Rp = 0.0765 Standard deviation of portfolio - WA=0.3, W8 -0.7, =0-1996, B =0:0729 'A=0.36, B=0-37, PAB=0.02916 - SCWA) + (p) & (88) + 2X WAX LWB X A X BX UAB + (0-3)* X0.1296+ (0.7 x 0729 + 2x0.3X0 1780.36X0.87 + 8 2 xo-02916 >10.01166 +0.03572 +0.00119 0.04857 - 92.04 7. or 0-2204 => RE = 0.02 Rp=0.0765 0 o=0-2204 Sharpe ratio= Rp. Rp 0.0765-0.02 0.0565 0.2204 0.2204 = 0.256 Problem 9 D Intro The return statistics for two stocks and T-bills are given below: A B 1 Stock A Stock B T-bills 2 Expected return 0.094 0.069 0.02 3 Variance 0.1296 0.0729 4 Standard deviation 0.36 0.27 5 Covariance 0.02916 Part 1 Attempt 1/10 for 10 pts. What is the Sharpe ratio of a portfolio with 30% invested in stock A and the rest in stock B? 3+ decimals Submit Attempt 1/10 for 10 pts. Part 2 What is the Sharpe ratio of the optimal risky portfolio? 3+ decimals Submit Expert Answer Anonymous answered this 52 answers B 0.094 0.066 0.36 0.27 0.02 0.02916 1 Expected Return on Stock A 2 Expected Return on Stock B 3 Standard Deviation of Stock A 4 Standard Deviation of Stock B 5 Risk Free Rate 6 Covariance 7 8 Proportion of Equity Fund in Optimal Risky Portfolio 9 Proportion of Bond in Optimal Risky Portfolio 10 Expected Return of Optimal Portfolio 11 Standard Deviation of Optimal Portfolio 12 Sharpe Ratio of the optimal risky portfolio 0.5159 0.4841 0.0804 0.0581 104.062% Formulas Used: - Expected Return on Stock A 0.094 Expected Return on Stock B 0.066 Standard Deviation of Stock A 0.36 Standard Deviation of Stock B 0.27 Risk Free Rate 0.02 Covariance 0.02916 Proportion of Equity Fund in Optimal Risky Portfolio =((B1-B5)*B4^2-(B2-B5)*B6)/((B1-B5)*B4^2+(B2- B5)*B3^2-(B1-B5-B2-B5)*86) Bond in Optimal Risky Proportion Portfolio =1-B8 Expected Return of Optimal Portfolio =(B8*B1)+(B2*B9) Standard Deviation of Optimal Portfolio =SQRT((B8^2*B1^2)+(B9^2*B2^2)+(2*B6*B8*B9/10000)) Sharpe Ratio of the optimal risky portfolio =(B10-B5)/B11 Vic Bepected return - 0.3x0.094 +0.7% 0.069. = 0.0282 +0.0483 Rp = 0.0765 Standard deviation of portfolio - WA=0.3, W8 -0.7, =0-1996, B =0:0729 'A=0.36, B=0-37, PAB=0.02916 - SCWA) + (p) & (88) + 2X WAX LWB X A X BX UAB + (0-3)* X0.1296+ (0.7 x 0729 + 2x0.3X0 1780.36X0.87 + 8 2 xo-02916 >10.01166 +0.03572 +0.00119 0.04857 - 92.04 7. or 0-2204 => RE = 0.02 Rp=0.0765 0 o=0-2204 Sharpe ratio= Rp. Rp 0.0765-0.02 0.0565 0.2204 0.2204 = 0.256

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts