Question: The answer is not those two!!!!!!!!! The answer is not those two!!!!!!!!! The answer is not those two!!!!!!!!! The answer is not those two!!!!!!!!! The

The answer is not those two!!!!!!!!!

The answer is not those two!!!!!!!!!

The answer is not those two!!!!!!!!!

The answer is not those two!!!!!!!!!

The answer is not those two!!!!!!!!!

The answer is not those two!!!!!!!!!

The answer is not those two!!!!!!!!!

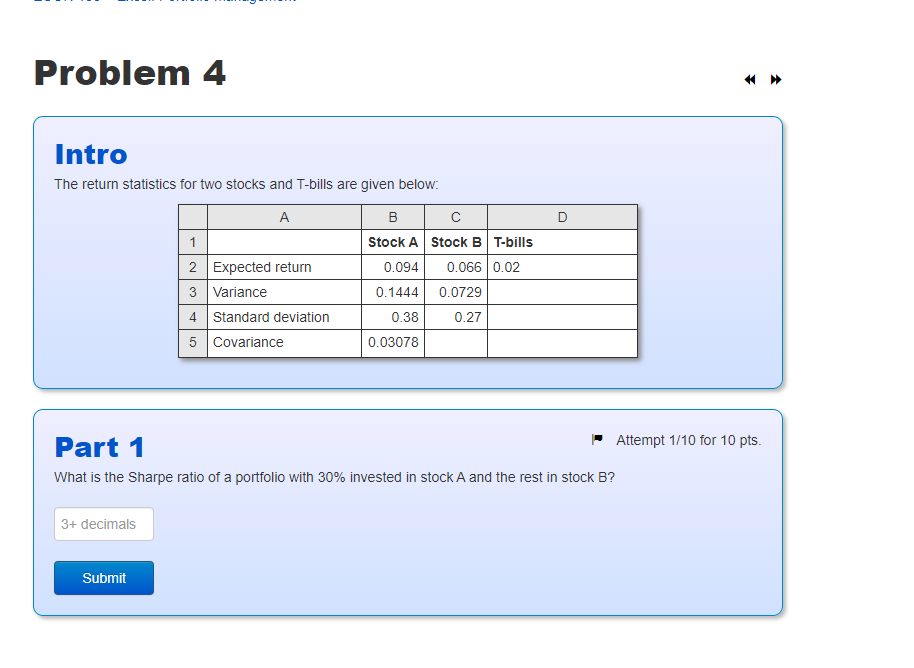

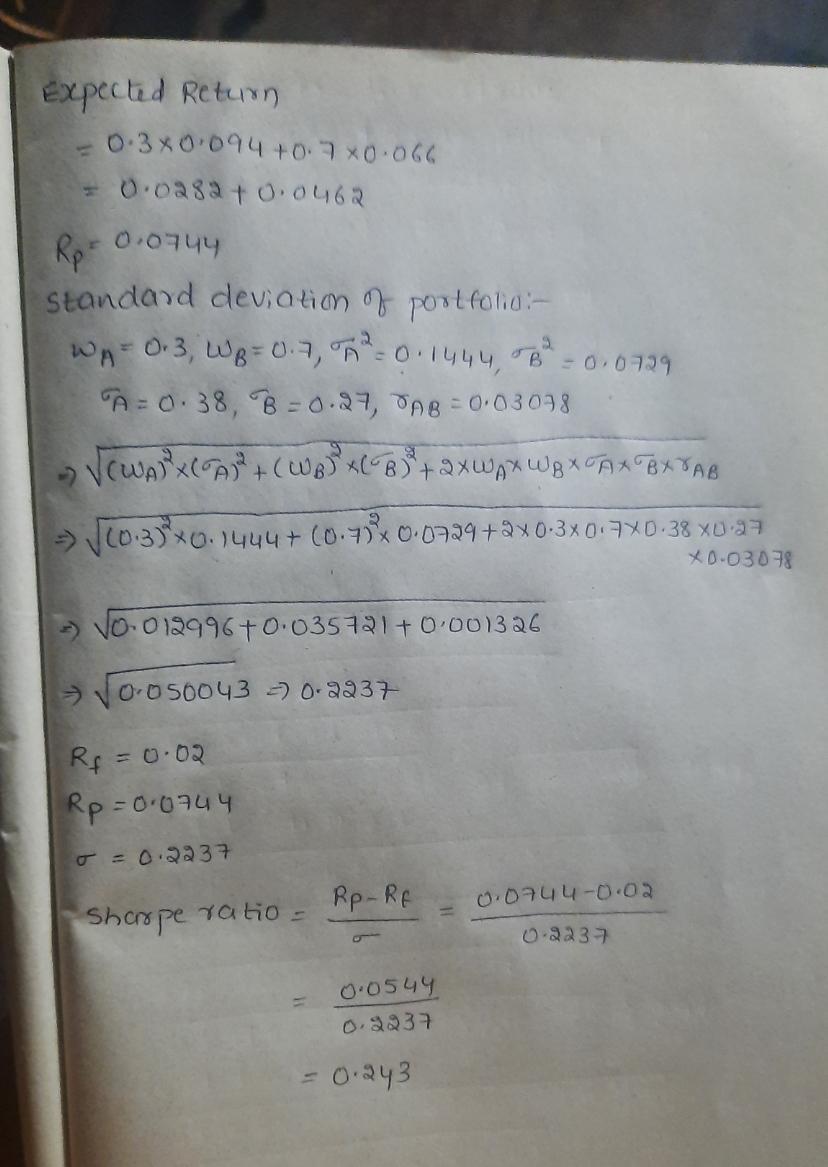

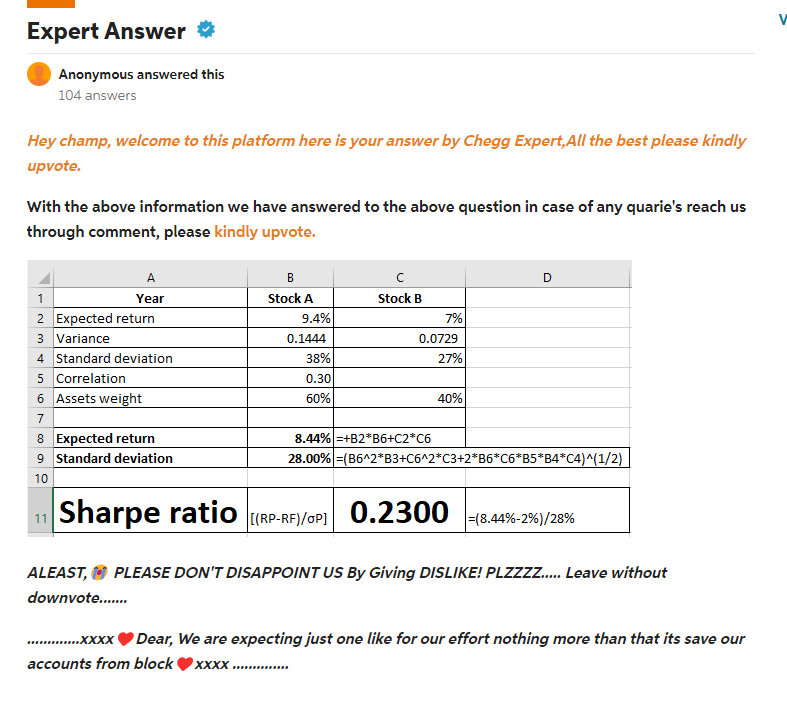

Problem 4 D Intro The return statistics for two stocks and T-bills are given below: A B 1 Stock A Stock B T-bills 2 Expected return 0.094 0.066 0.02 3 Variance 0.1444 0.0729 4 Standard deviation 0.38 0.27 5 Covariance 0.03078 Part 1 Attempt 1/10 for 10 pts. What is the Sharpe ratio of a portfolio with 30% invested in stock A and the rest in stock B? 3+ decimals Submit Expected Return 0.3x0.094 +0.7x0.066 = 0.0282 +0.0462 Rp 0.0744 Standard deviation of portfolio:- WA 0:3, Wp = 0.7 0.1444, B = 0.0729 A=0.38, B=0.27, A8 = 0.03098 VWA) X (A) + (WB) x (B) + 2 x WAX WB X TAX BXY AB >100:37**0.1444+(0.40.0739 +aX0-320-7X0.38 xU- 0-03078 -> VO-012996+0.035721 +0.001326 VO-050043 -) 0-9237 Rf = 0.02 Rp=0.0744 o = 0.2237 Rp-RE 0.0744-0.02 Sherpe ratio 0-2237 0.0544 0.2237 - 0.243 Expert Answer Anonymous answered this 104 answers Hey champ, welcome to this platform here is your answer by Chegg Expert,All the best please kindly upvote. With the above information we have answered to the above question in case of any quarie's reach us through comment, please kindly upvote. D A 1 Year 2 Expected return 3 Variance 4 Standard deviation 5 Correlation 6 Assets weight 7 8 Expected return 9 Standard deviation 10 B Stock A 9.4% 0.1444 38% 0.30 60% Stock B 7% 0.0729 27% 40% 8.44% =+B2*B6+C2*C6 28.00% =(B6^2*B3+C6^2*C3+2*36*C6*85*34*04)^(1/2) 1. Sharpe ratio (PRP-RF)/GP] 0.2300 =(8.44%-2%)/28% ALEAST, PLEASE DON'T DISAPPOINT US By Giving DISLIKE! PLZZZZ..... Leave without downvote.... .............XXXX Dear, We are expecting just one like for our effort nothing more than that its save our accounts from block XXXX ..... Problem 4 D Intro The return statistics for two stocks and T-bills are given below: A B 1 Stock A Stock B T-bills 2 Expected return 0.094 0.066 0.02 3 Variance 0.1444 0.0729 4 Standard deviation 0.38 0.27 5 Covariance 0.03078 Part 1 Attempt 1/10 for 10 pts. What is the Sharpe ratio of a portfolio with 30% invested in stock A and the rest in stock B? 3+ decimals Submit Expected Return 0.3x0.094 +0.7x0.066 = 0.0282 +0.0462 Rp 0.0744 Standard deviation of portfolio:- WA 0:3, Wp = 0.7 0.1444, B = 0.0729 A=0.38, B=0.27, A8 = 0.03098 VWA) X (A) + (WB) x (B) + 2 x WAX WB X TAX BXY AB >100:37**0.1444+(0.40.0739 +aX0-320-7X0.38 xU- 0-03078 -> VO-012996+0.035721 +0.001326 VO-050043 -) 0-9237 Rf = 0.02 Rp=0.0744 o = 0.2237 Rp-RE 0.0744-0.02 Sherpe ratio 0-2237 0.0544 0.2237 - 0.243 Expert Answer Anonymous answered this 104 answers Hey champ, welcome to this platform here is your answer by Chegg Expert,All the best please kindly upvote. With the above information we have answered to the above question in case of any quarie's reach us through comment, please kindly upvote. D A 1 Year 2 Expected return 3 Variance 4 Standard deviation 5 Correlation 6 Assets weight 7 8 Expected return 9 Standard deviation 10 B Stock A 9.4% 0.1444 38% 0.30 60% Stock B 7% 0.0729 27% 40% 8.44% =+B2*B6+C2*C6 28.00% =(B6^2*B3+C6^2*C3+2*36*C6*85*34*04)^(1/2) 1. Sharpe ratio (PRP-RF)/GP] 0.2300 =(8.44%-2%)/28% ALEAST, PLEASE DON'T DISAPPOINT US By Giving DISLIKE! PLZZZZ..... Leave without downvote.... .............XXXX Dear, We are expecting just one like for our effort nothing more than that its save our accounts from block XXXX

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts