Question: The answer is shown above but I need a simple explanation! The question here is to calculate the price, expected return in %, and risk

The answer is shown above but I need a simple explanation! The question here is to calculate the price, expected return in %, and risk premium in % as well. Also what do they mean by risk-free zero-coupon bond?

--The probability associated with payout in both economic conditions is assumed to 50% strong & 50% weak.

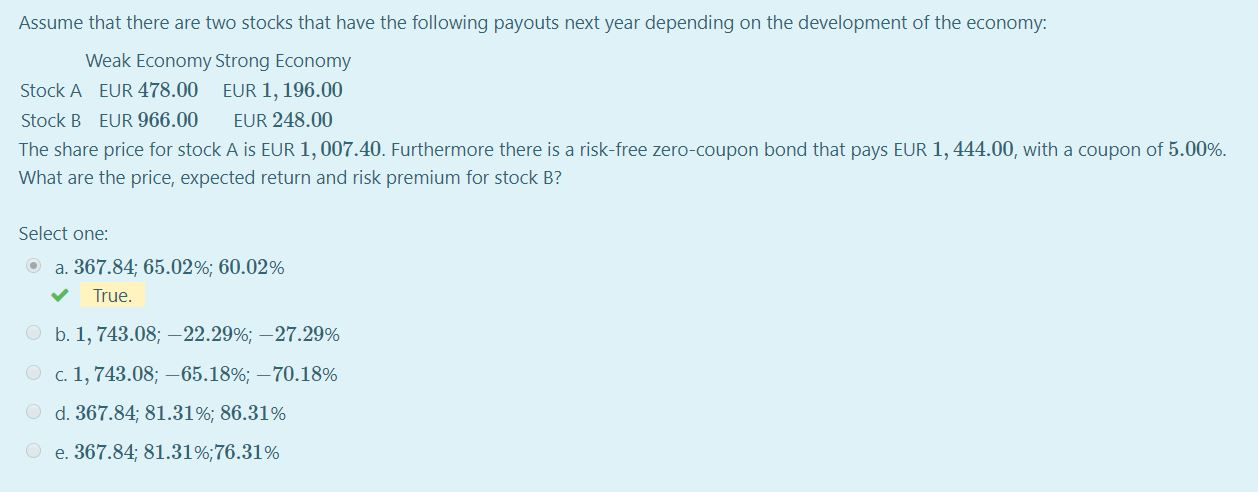

Assume that there are two stocks that have the following payouts next year depending on the development of the economy: Weak Economy Strong Economy Stock A EUR 478.00 EUR 1,196.00 Stock B EUR 966.00 EUR 248.00 The share price for stock A is EUR 1, 007.40. Furthermore there is a risk-free zero-coupon bond that pays EUR 1, 444.00, with a coupon of 5.00%. What are the price, expected return and risk premium for stock B? Select one: a. 367.84; 65.02%; 60.02% True. b. 1, 743.08; -22.29%; 27.29% c. 1,743.08; -65.18%; 70.18% O d. 367.84; 81.31%; 86.31% O e. 367.84; 81.31%;76.31%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts