Question: the answer is wrong,, please help, the formula provided LO) estion Help You invested in the no-load Best Mutual Fund one year ago by purchasing

the answer is wrong,, please help, the formula provided

the answer is wrong,, please help, the formula provided

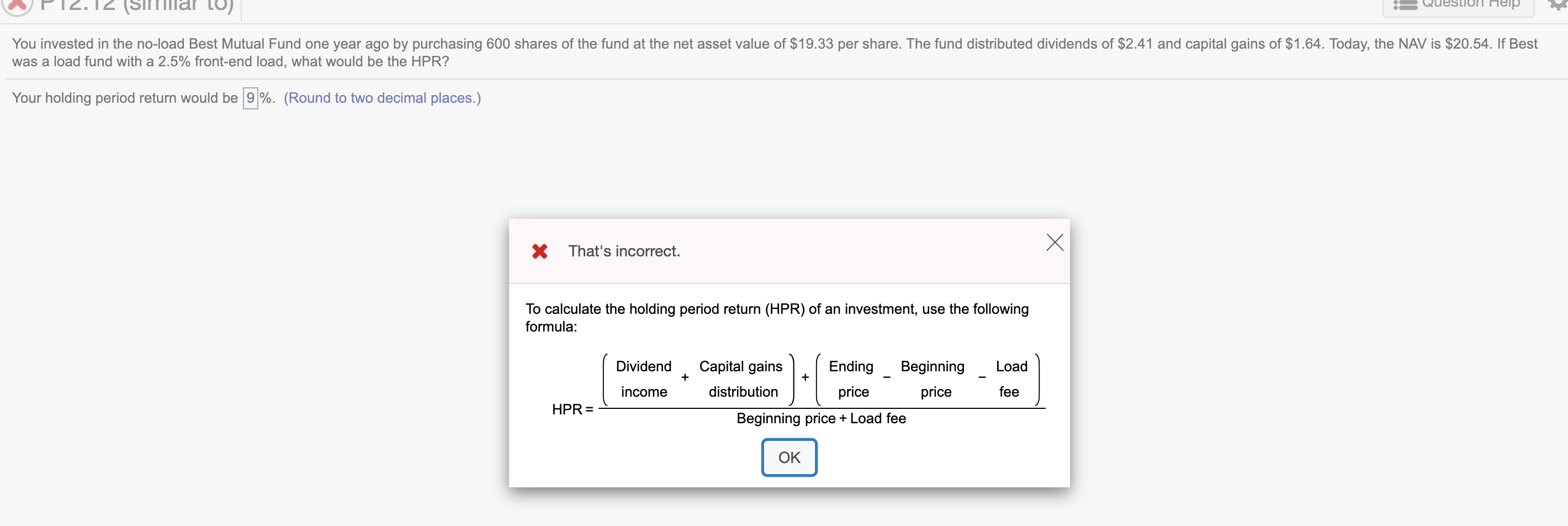

LO) estion Help You invested in the no-load Best Mutual Fund one year ago by purchasing 600 shares of the fund at the net asset value of $19.33 per share. The fund distributed dividends of $2.41 and capital gains of $1.64. Today, the NAV is $20.54. If Best was a load fund with a 2.5% front-end load, what would be the HPR? Your holding period return would be 9%. (Round to two decimal places.) X X That's incorrect. To calculate the holding period return (HPR) of an investment, use the following formula: Dividend Load + + income Capital gains Ending Beginning distribution price price Beginning price + Load fee fee HPR = OK

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts