Question: The answer list for first column is displayed. the second column answer list for each option is: r*, DRP, r RF, IP, LP, MRP 2.

The answer list for first column is displayed. the second column answer list for each option is: r*, DRP, rRF, IP, LP, MRP

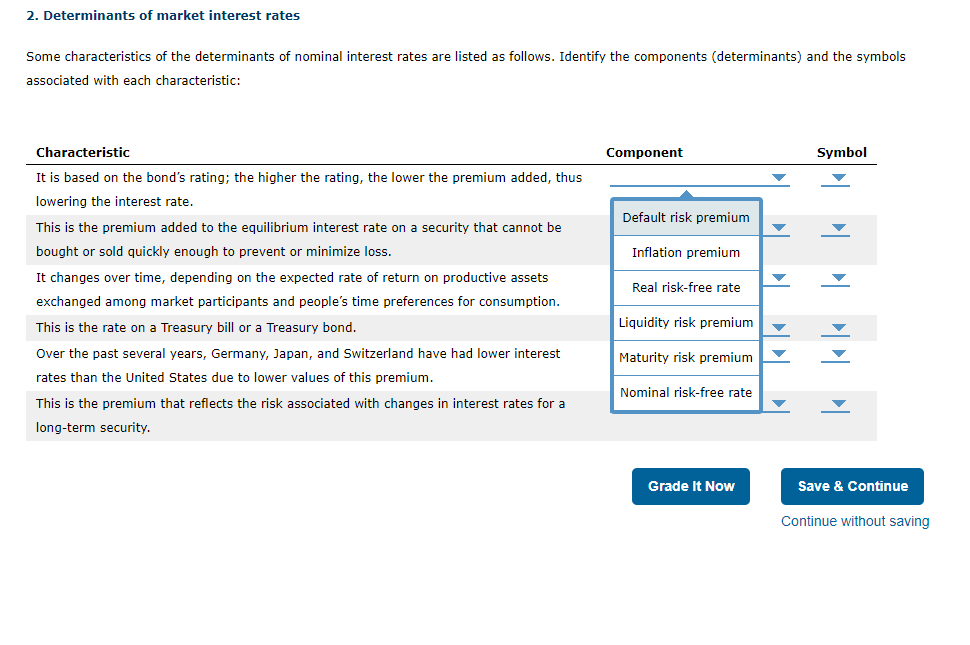

2. Determinants of market interest rates Some characteristics of the determinants of nominal interest rates are listed as follows. Identify the components (determinants) and the symbols associated with each characteristic: Component Symbol Default risk premium Inflation premium Characteristic It is based on the bond's rating; the higher the rating, the lower the premium added, thus lowering the interest rate. This is the premium added to the equilibrium interest rate on a security that cannot be bought or sold quickly enough to prevent or minimize loss. It changes over time, depending on the expected rate of return on productive assets exchanged among market participants and people's time preferences for consumption. This is the rate on a Treasury bill or a Treasury bond. Over the past several years, Germany, Japan, and Switzerland have had lower interest rates than the United States due to lower values of this premium. This is the premium that reflects the risk associated with changes in interest rates for a long-term security. Real risk-free rate Liquidity risk premium Maturity risk premium la la Nominal risk-free rate Grade It Now Save & Continue Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts