Question: the answer needs to be a percentage value Suppose you purchase a 8 year AAA-rated Swiss bond for par that is paying an annual coupon

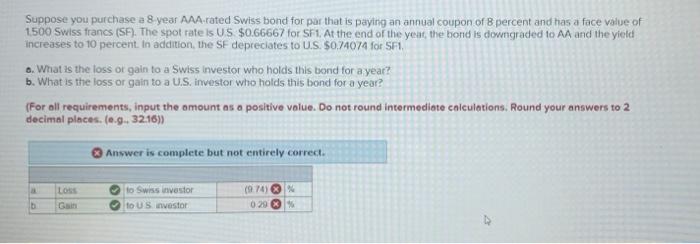

Suppose you purchase a 8 year AAA-rated Swiss bond for par that is paying an annual coupon of 8 percent and has a face value of 1.500 Swiss francs. (SF). The spot rate is U.S $0.66667 for SF1, At the end of the yeat, the bond is downgraded to AA and the yield incleases to to percent. th addition, the SF depreciates to U.S. 50.74074 for SF1. Q. What is the loss or gain to a Swiss investor who holds this bond for a year? b. What is the loss or gain to a U.S. investor who holds this bond for a year? (For all requirements, input the omount as a positive value. Do not round intermediate colculations, Round your answers to 2 decimal places. (0.9,32.16))

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts