Question: The answer of this exercise in this below spreadsheet. We are trying to analyze the above exercise. How does it help the company's financial strategy?

The answer of this exercise in this below spreadsheet.

We are trying to analyze the above exercise. How does it help the company's financial strategy? What changes could be made? Discuss anything else pertinent to the exercise.

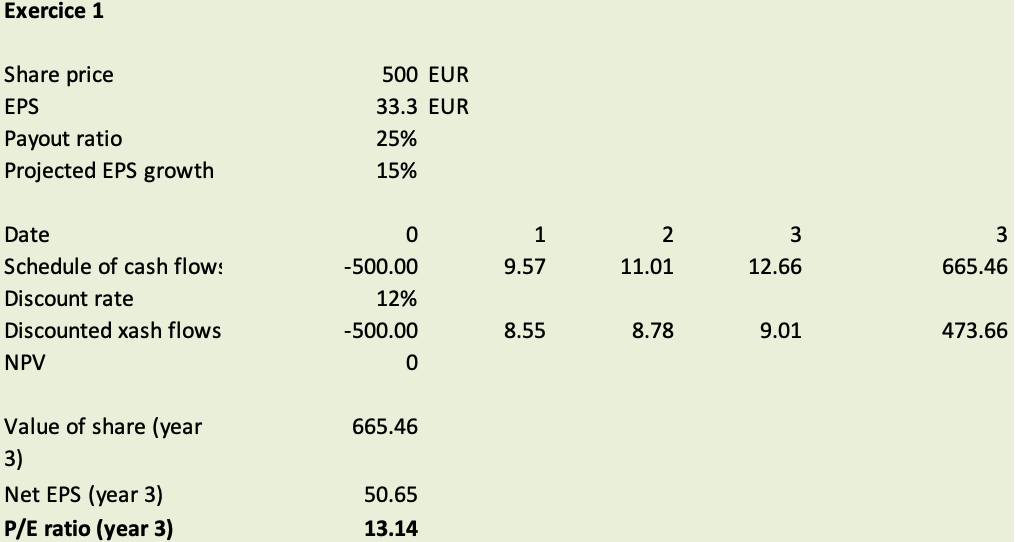

1/You buy a stock which has the following features: price: 500 EPS: 33.3 payout ratio: 25% projected EPS growth 15% What will EPS have to be equal to in year 3 for you to get a 12% return on your invest- ment? What will the share be worth then? Exercice 1 Share price EPS Payout ratio Projected EPS growth 500 EUR 33.3 EUR 25% 15% 0 3 3 1 9.57 2 11.01 12.66 665.46 Date Schedule of cash flows Discount rate Discounted xash flows NPV -500.00 12% -500.00 8.55 8.78 9.01 473.66 0 665.46 Value of share (year 3) Net EPS (year 3) P/E ratio (year 3) 50.65 13.14

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts