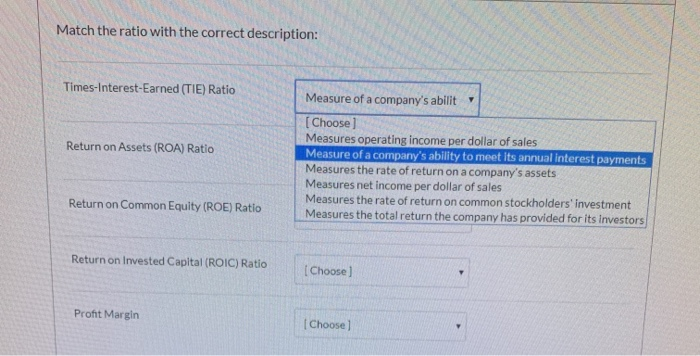

Question: The answer options for the second question is the same as the first drop down Match the ratio with the correct description: Times-Interest-Earned (TIE) Ratio

The answer options for the second question is the same as the first drop down

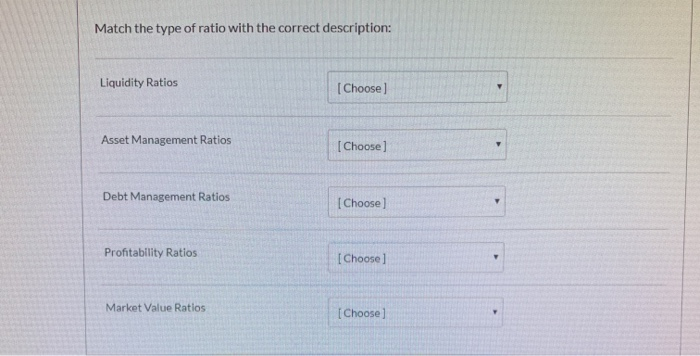

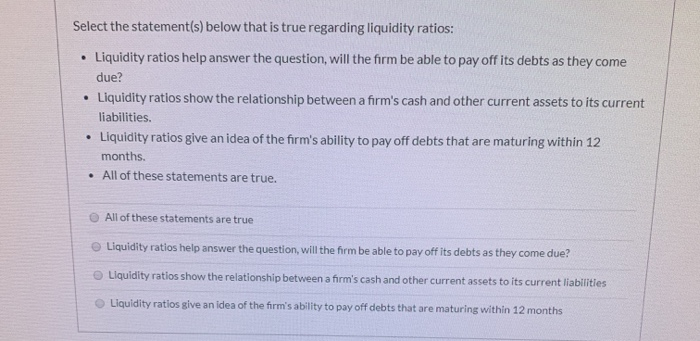

Match the ratio with the correct description: Times-Interest-Earned (TIE) Ratio Return on Assets (ROA) Ratio Measure of a company's abilit [Choose] Measures operating income per dollar of sales Measure of a company's ability to meet its annual interest payments Measures the rate of return on a company's assets Measures net income per dollar of sales Measures the rate of return on common stockholders'investment Measures the total return the company has provided for its Investors Return on Common Equity (ROE) Ratio Return on invested Capital (ROIC) Ratio [Choose Pront Margin [Choose Match the type of ratio with the correct description: Liquidity Ratios [Choose] Asset Management Ratios [Choose] Debt Management Ratios Choose) Profitability Ratios [Choose] Market Value Ratios [Choose Select the statement(s) below that is true regarding liquidity ratios: Liquidity ratios help answer the question, will the firm be able to pay off its debts as they come due? Liquidity ratios show the relationship between a firm's cash and other current assets to its current liabilities. Liquidity ratios give an idea of the firm's ability to pay off debts that are maturing within 12 months. All of these statements are true. All of these statements are true Liquidity ratios help answer the question, will the form be able to pay off its debts as they come due? Liquidity ratios show the relationship between a firm's cash and other current assets to its current liabilities Liquidity ratios give an idea of the firm's ability to pay off debts that are maturing within 12 months Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock