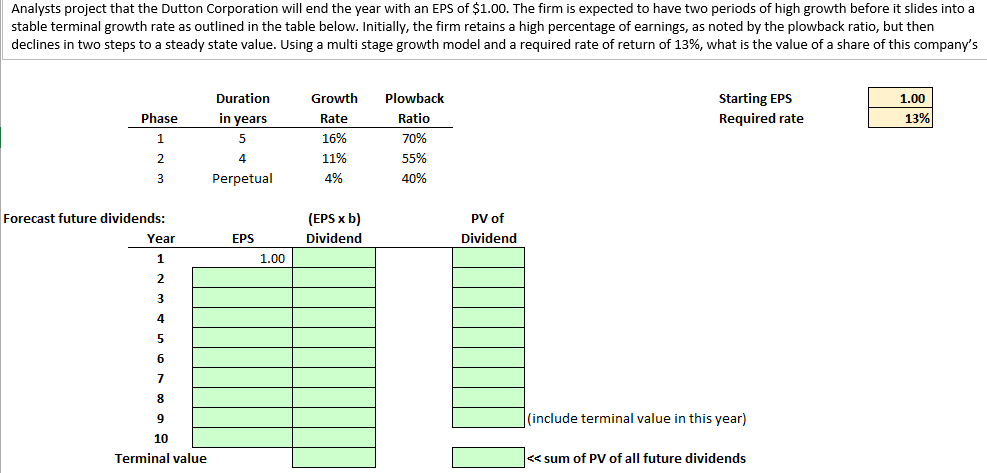

Question: The answer provided is P = $9.44. Can you please fill out this chart and what formulas are used. All is done in Excel. Analysts

The answer provided is P = $9.44. Can you please fill out this chart and what formulas are used. All is done in Excel.

Analysts project that the Dutton Corporation will end the year with an EPS of $1.00. The firm is expected to have two periods of high growth before it slides into a stable terminal growth rate as outlined in the table below. Initially, the firm retains a high percentage of earnings, as noted by the plowback ratio, but then declines in two steps to a steady state value. Using a multi stage growth model and a required rate of return of 13%, what is the value of a share of this company's Starting EPS Required rate \begin{tabular}{|r|} \hline 1.00 \\ \hline 13% \\ \hline \end{tabular} Forecast future div clude terminal value in this year) : sum of PV of all future dividends

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts