Question: The answer selected for the first question is correct and I did not include the answer for the second question. When I try to work

The answer selected for the first question is correct and I did not include the answer for the second question. When I try to work these problems out, I get the wrong answers. Please walk me through these and be as detailed as possible. Thank you in advance.

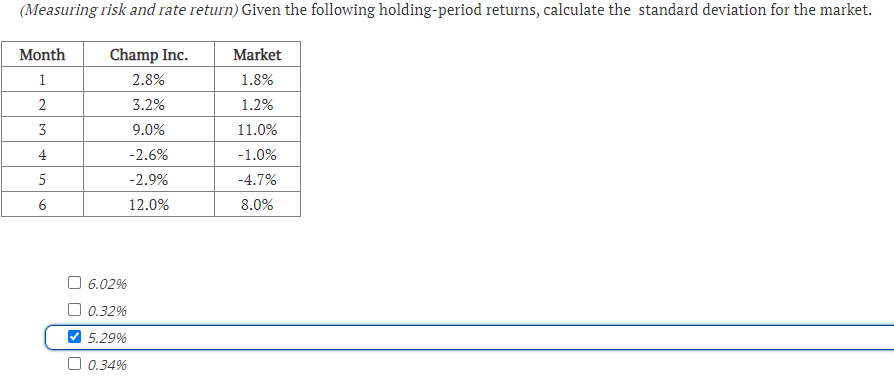

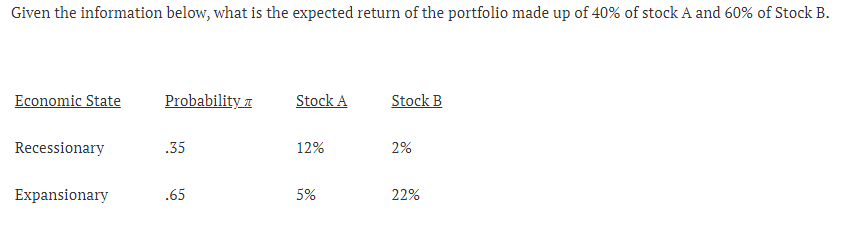

(Measuring risk and rate return) Given the following holding-period returns, calculate the standard deviation for the market. Month 1 Champ Inc. 2.8% 3.2% Market 1.8% 1.2% 2 3 9.0% 11.0% 4 4 -2.6% -1.0% 5 -2.9% -4.7% 8.0% 6 6 12.0% 06.0296 O 0.32% 5.29% O 0.34% Given the information below, what is the expected return of the portfolio made up of 40% of stock A and 60% of Stock B. Economic State Probability Stock A Stock B Recessionary .35 12% 2% Expansionary .65 5% 22%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts