Question: The answer that you see is incorrect. QUESTION 15 Sandra, a tax professional, prepares Linda's income tax return. Lindo sold some stock in a corporation

The answer that you see is incorrect.

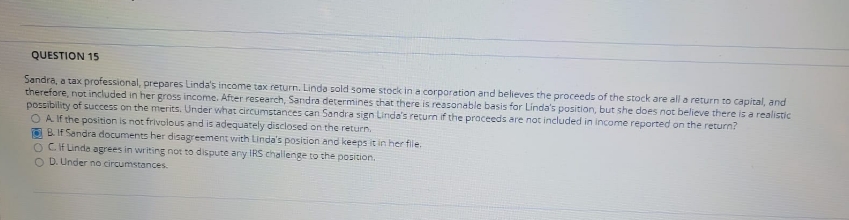

QUESTION 15 Sandra, a tax professional, prepares Linda's income tax return. Lindo sold some stock in a corporation and believes the proceeds of the stock are all a return to capital, and therefore, not included in her gross income. After research, Sandra determines that there is reasonable basis for Linda's position, but she does not believe there is a realistic possibility of success on the merits. Under what circumstances can Sandra sign Linda's recur if the proceeds are not included in income reported on the return? O A. If the position is not frivolous and is adequately disclosed on the return, B. If Sandra documents her disagreement with Linda's position and keeps it in her file. O C. If Linda agrees in writing not to dispute any IRS challenge to the position. ) D. Under no circumstances

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts