Question: . The apparel division will create a continuous working capital needs, which have been estimated as follows: The sale of apparel on credit to wholesalers

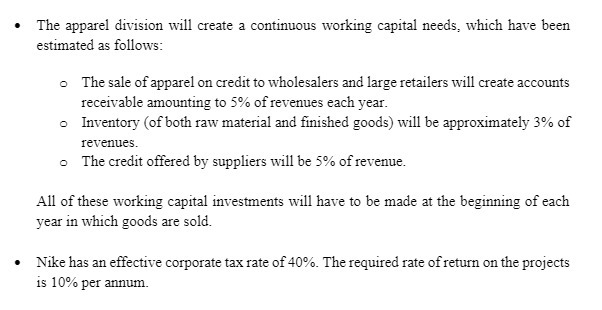

. The apparel division will create a continuous working capital needs, which have been estimated as follows: The sale of apparel on credit to wholesalers and large retailers will create accounts receivable amounting to 5% of revenues each year. o Inventory (of both raw material and finished goods) will be approximately 3% of revenues. The credit offered by suppliers will be 5% of revenue. All of these working capital investments will have to be made at the beginning of each year in which goods are sold. Nike has an effective corporate tax rate of 40%. The required rate of return on the projects is 10% per annum

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts