Question: The assignment for this problem is to prepare the Bobcat Beverage Company, Inc., comprehensive budget for September 2022 and October 2022. Your budget MUST be

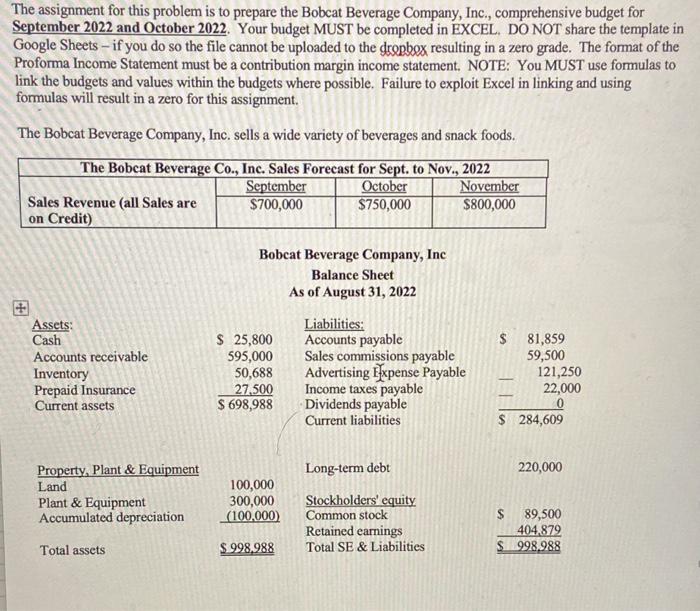

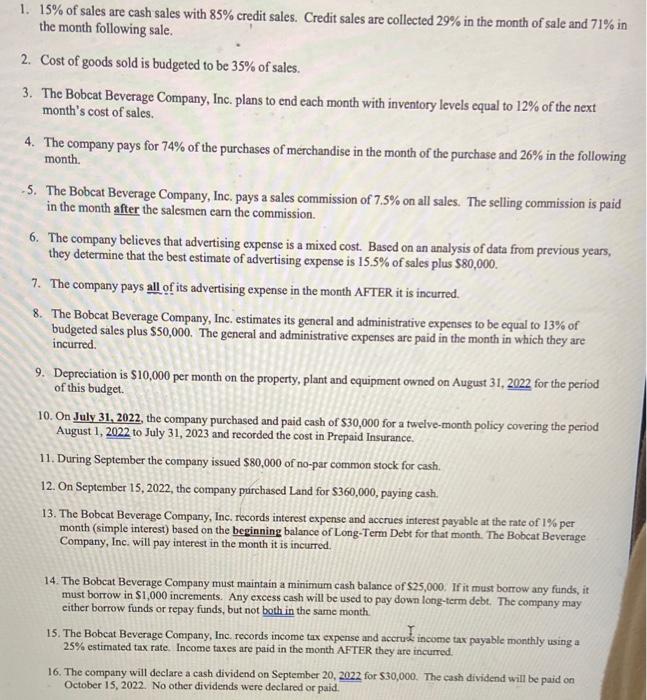

The assignment for this problem is to prepare the Bobcat Beverage Company, Inc., comprehensive budget for September 2022 and October 2022. Your budget MUST be completed in EXCEL. DO NOT share the template in Google Sheets - if you do so the file cannot be uploaded to the dropbex resulting in a zero grade. The format of the Proforma Income Statement must be a contribution margin income statement. NOTE: You MUST use formulas to link the budgets and values within the budgets where possible. Failure to exploit Excel in linking and using formulas will result in a zero for this assignment. The Bobcat Beverage Company, Inc. sells a wide variety of beverages and snack foods. Bobcat Beverage Company, Inc Balance Sheet As of August 31, 2022 1. 15% of sales are cash sales with 85% credit sales. Credit sales are collected 29% in the month of sale and 71% in the month following sale. 2. Cost of goods sold is budgeted to be 35% of sales. 3. The Bobcat Beverage Company, Inc. plans to end each month with inventory levels equal to 12% of the next month's cost of sales. 4. The company pays for 74% of the purchases of merchandise in the month of the purchase and 26% in the following month. -5. The Bobcat Beverage Company, Inc. pays a sales commission of 7.5% on all sales. The selling commission is paid in the month after the salesmen earn the commission. 6. The company believes that advertising expense is a mixed cost. Based on an analysis of data from previous years, they determine that the best estimate of advertising expense is 15.5% of sales plus $80,000. 7. The company pays all of its advertising expense in the month AFTER it is incurred. 8. The Bobcat Beverage Company, Inc. estimates its general and administrative expenses to be equal to 13% of budgeted sales plus $50,000. The general and administrative expenses are paid in the month in which they are incurred. 9. Depreciation is $10,000 per month on the property, plant and equipment owned on August 31,2022 for the period of this budget. 10. On July 31, 2022, the company purchased and paid cash of $30,000 for a twelve-month policy covering the period August 1, 2022 to July 31, 2023 and recorded the cost in Prepaid Insurance. 11. During September the company issued $80,000 of no-par common stock for cash. 12. On September 15,2022 , the company purchased Land for $360,000, paying cash. 13. The Bobcat Beverage Company, Inc. records interest expense and accrues interest payable at the rate of 1% per month (simple interest) based on the beginning balance of Long-Term Debt for that month. The Bobcat Beverage Company, Inc. will pay interest in the month it is incurred. 14. The Bobcat Beverage Company must maintain a minimum cash balance of $25,000. If it must borrow any funds, it must borrow in $1,000 increments. Any excess cash will be used to pay down long-term debe. The company may either borrow funds or repay funds, but not both in the same month. 15. The Bobeat Beverage Company, Inc, records income tax expense and accruit income tax puyable monthly wing a 25% estimated tax rate. Income taxes are paid in the month AFTER they are incurred. 16. The company will declare a cash dividend on September 20,2022 for $30,000. The cash dividend will be paid on October 15, 2022. No other dividends were declared or paid

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts