Question: A Ltd acquired a 60% shareholding interest in B Ltd in 20x4. B Ltd acquired a 40% shareholding interest in C Ltd in 20x5.

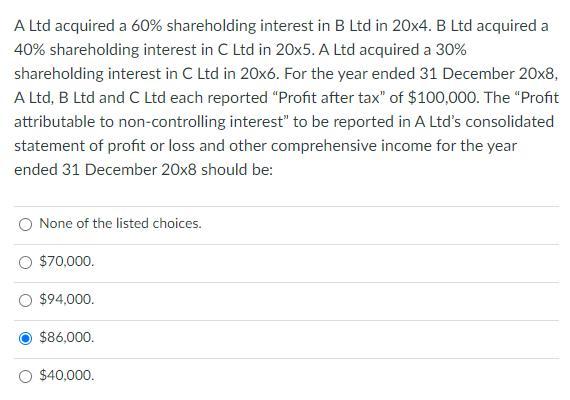

A Ltd acquired a 60% shareholding interest in B Ltd in 20x4. B Ltd acquired a 40% shareholding interest in C Ltd in 20x5. A Ltd acquired a 30% shareholding interest in C Ltd in 20x6. For the year ended 31 December 20x8, A Ltd, B Ltd and C Ltd each reported "Profit after tax" of $100,000. The "Profit attributable to non-controlling interest" to be reported in A Ltd's consolidated statement of profit or loss and other comprehensive income for the year ended 31 December 20x8 should be: None of the listed choices. $70,000. $94,000. $86,000. $40,000.

Step by Step Solution

3.58 Rating (179 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provided below To the NCI of B Ltd and C calculate Gmb... View full answer

Get step-by-step solutions from verified subject matter experts