Question: The assignment will be marked based on (1) How you arrive at the solution, (2) Is the solution logical, consistent with the materials taught in

The assignment will be marked based on (1) How you arrive at the solution, (2) Is the solution logical, consistent with the materials taught in class? (3) The presentation of your results. Remember, you must present your work in a clear and concise manner. How you communicate your work visually and verbally matters. You are require to submit a spreadsheet with your calculations for the numerical questions and a separate document with the answer for the conceptual questions and where you show the key steps involved to get the solution of the numerical questions.

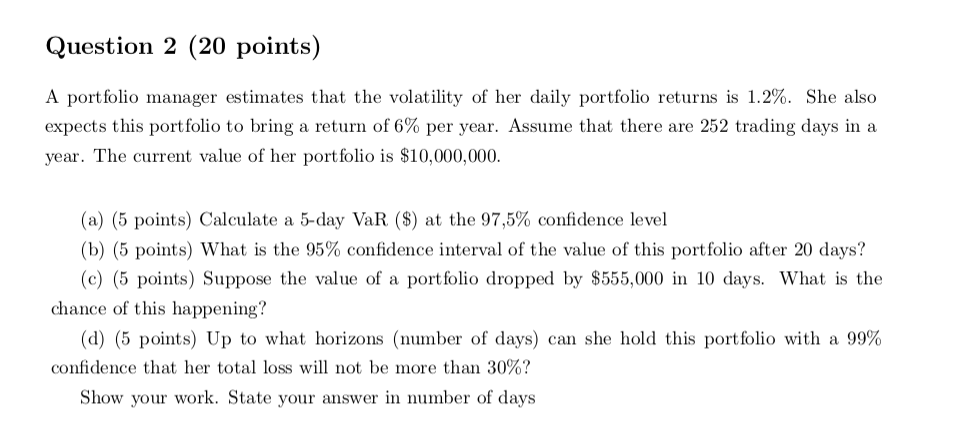

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts