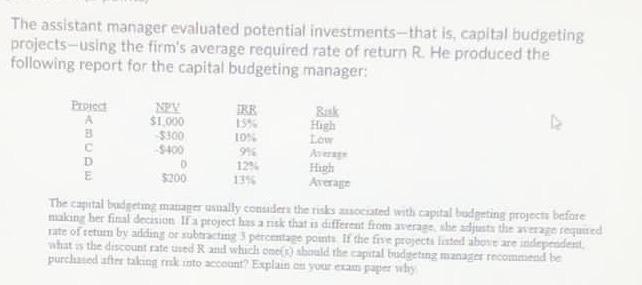

Question: The assistant manager evaluated potential investments-that is, capital budgeting projects-using the firm's average required rate of return R. He produced the following report for the

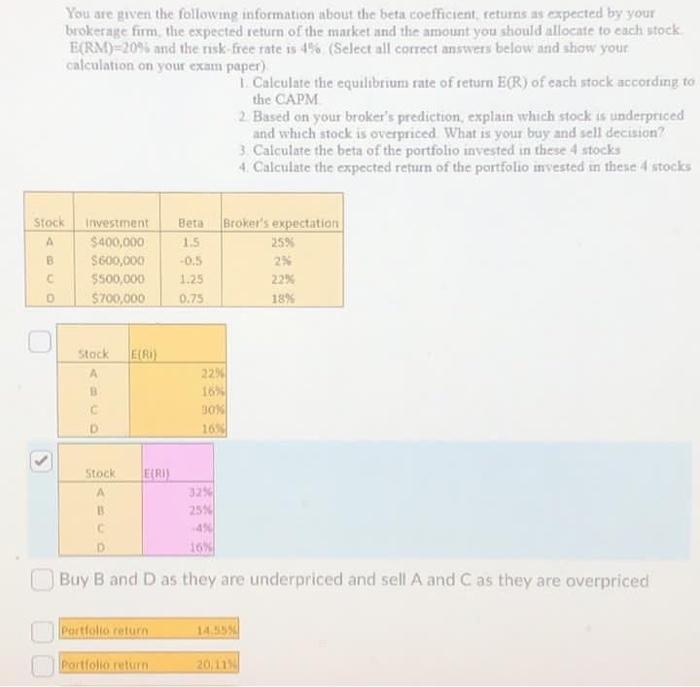

The assistant manager evaluated potential investments-that is, capital budgeting projects-using the firm's average required rate of return R. He produced the following report for the capital budgeting manager: Pro NOY Bak $1.000 15 5500 10% Low 5400 94 12 $200 115 Arora The capital budgetma maternally conudes the risks mocated with capital budgeting projects before makin ber final decision of project has a risk that is different from ease the state recepted rate of return by adding or subtract percentage points. If the fise projecte ed or are indepedent what the discount rate tred and which one should the capital budgeting manages recommend be purchased after taking into count? Explain on your exam paper why You are given the followme information about the beta coefficient, returns as expected by your brokerage firm, the expected return of the market and the amount you should allocate to each stock E(RM)=20% and the risk-free rate is 4% (Select all correct answers below and show your calculation on your cxam paper) 1. Calculate the equilibrium rate of return E(R) of each stock according to the CAPM 2. Based on your broker's prediction, explain which stock is underpriced and which stock is overpriced What is your buy and sell decision 3. Calculate the beta of the portfolio invested in these 4 stocks 4. Calculate the expected return of the portfolio invested in these 4 stocks Stock investment $400,000 $600,000 $500,000 $700,000 Beta 1.5 -0.5 1.25 0.75 Broker's expectation 259 23 22% 18% Stock A B 229 16 30% 16 D Stock ERI 325 25% 4 16% D Buy B and D as they are underpriced and sell A and C as they are overpriced Portfolio return 14.30 Portfolio return 2011

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts