Question: The attached data are the annual returns for two mutual funds offered by the investment giant Fidelity for the years 2001-2017. The Fidelity Select Automotive

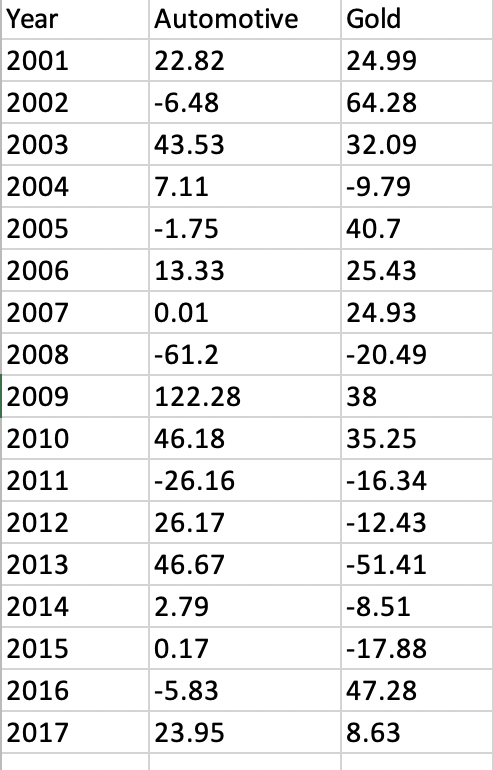

The attached data are the annual returns for two mutual funds offered by the investment giant Fidelity for the years 2001-2017. The Fidelity Select Automotive mutual fund invests primarily in companies engaged in the manufacturing, marketing, or sales of automobiles, trucks, specialty vehicles, parts, tires, and related services. The Fidelity Gold mutual fund investments primarily in companies engaged in the exploration, mining, processing, or dealing in gold and, to a lesser degree, in other precious metals and minerals. In a report, use the sample information to

Determine the mean averages of the data provided.

Calculate the descriptive statistics to compare the returns of the mutual funds.

Asses the rewards by constructing and interpreting 95% confidence intervals for the population mean return.

What assumptions did you make when constructing the confidence intervals?

Automotive Gold Year 2001 22.82 24.99 2002 -6.48 64.28 2003 43.53 32.09 2004 7.11 -9.79 2005 -1.75 40.7 2006 13.33 25.43 2007 0.01 24.93 -20.49 2008 -61.2 2009 122.28 38 2010 35.25 2011 -16.34 46.18 -26.16 26.17 46.67 2012 -12.43 2013 -51.41 2014 2.79 -8.51 2015 0.17 -17.88 2016 47.28 -5.83 23.95 2017 8.63Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts