Question: The attached Excel spreadsheet has already solved Part 1. Your task is to address the concerns raised in Part 2. Specifically, you will duplicate the

The attached Excel spreadsheet has already solved Part 1. Your task is to address the concerns raised in Part 2. Specifically, you will duplicate the Excel tables in Part 1 and conduct the sensitivity analysis of NPV to changes in the following:

1. Price of the new smart phone decreases by 20%.

2. The sale quantity of the new smartphone decreases by 5% from the estimated numbers. Upload your Excel file here before the deadline.

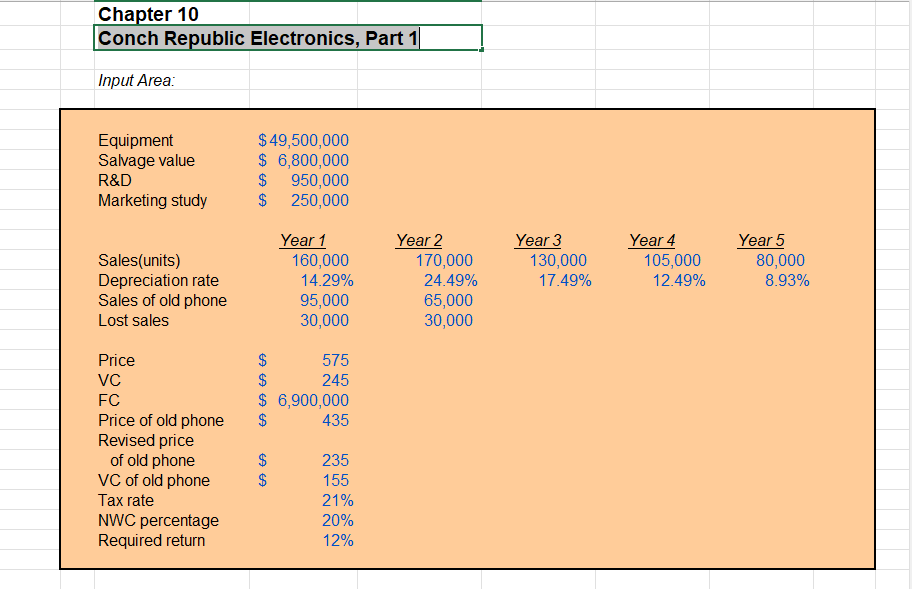

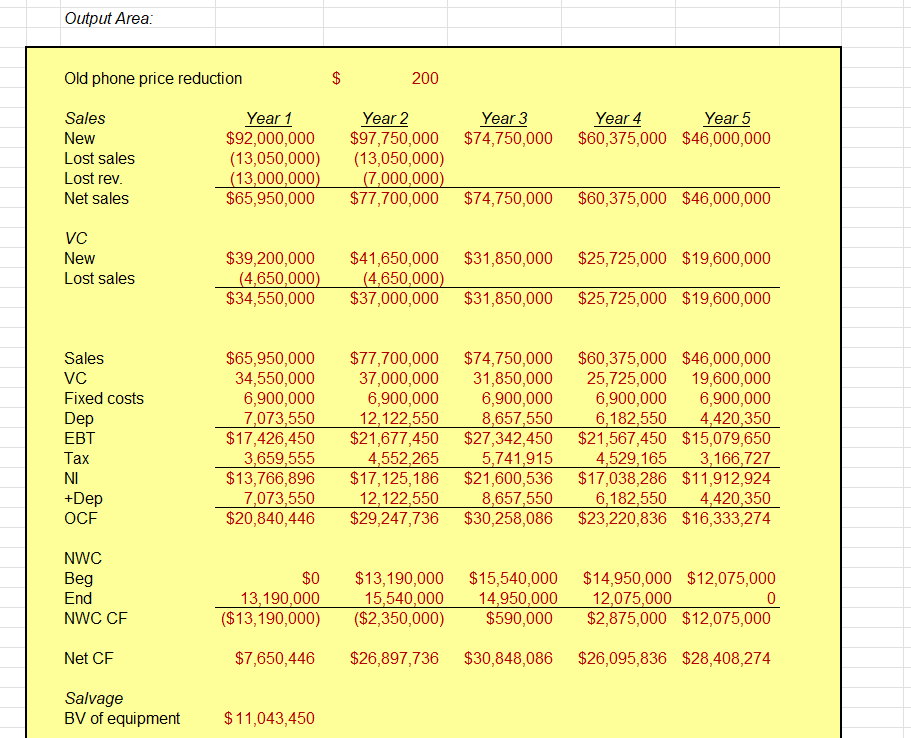

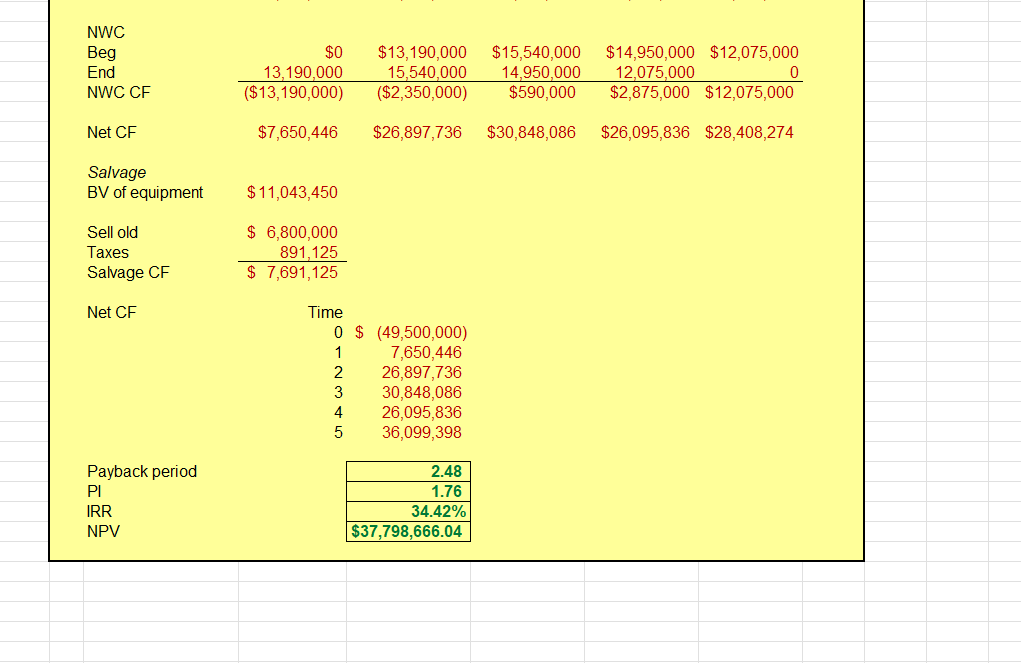

Chapter 10 Conch Republic Electronics, Part 1 Input Area: EquipmentSalvagevalueR&DMarketingstudy$49,500,000$6,800,000$950,000$250,000 PriceVCFC$$$5752456,900,000 Price of old phone $435 Revised price of old phone $235 VC of old phone $155 Tax rate 21% NWC percentage 20% Required return 12% Output Area: Old phone price reduction $200 SalesLostsalesLostrev.NetsalesNewYear1(13,000,000,000)(13,000,000)$65,950,000Year2$97,750,000(7,000,000)$77,700,000Year4Year3$74,750,000$74,750,000Year5$60,375,000$60,375,000$46,000,000$46,000,000 VC \begin{tabular}{lccccc} New & $39,200,000 & $41,650,000 & $31,850,000 & $25,725,000 & $19,600,000 \\ Lost sales & (4,650,000) & (4,650,000) & & & \\ \cline { 2 - 6 } & $34,550,000 & $37,000,000 & $31,850,000 & $25,725,000 & $19,600,000 \end{tabular} \begin{tabular}{lrrrrr} Sales & $65,950,000 & $77,700,000 & $74,750,000 & $60,375,000 & $46,000,000 \\ VC & 34,550,000 & 37,000,000 & 31,850,000 & 25,725,000 & 19,600,000 \\ Fixed costs & 6,900,000 & 6,900,000 & 6,900,000 & 6,900,000 & 6,900,000 \\ Dep & 7,073,550 & 12,122,550 & 8,657,550 & 6,182,550 & 4,420,350 \\ EBT & $17,426,450 & $21,677,450 & $27,342,450 & $21,567,450 & $15,079,650 \\ Tax & 3,659,555 & 4,552,265 & 5,741,915 & 4,529,165 & 3,166,727 \\ \hline NI & $13,766,896 & $17,125,186 & $21,600,536 & $17,038,286 & $11,912,924 \\ +Dep & 7,073,550 & 12,122,550 & 8,657,550 & 6,182,550 & 4,420,350 \\ OCF & $20,840,446 & $29,247,736 & $30,258,086 & $23,220,836 & $16,333,274 \end{tabular} NWC Beg End NWC CF \begin{tabular}{rrcrr} 13,190,000 & 15,540,000 & 14,950,000 & 12,075,000 & 0 \\ \hline($13,190,000) & ($2,350,000) & $590,000 & $2,875,000 & $12,075,000 \end{tabular} Net CF $7,650,446$26,897,736$30,848,086$26,095,836$28,408,274 Salvage BV of equipment $11,043,450 Chapter 10 Conch Republic Electronics, Part 1 Input Area: EquipmentSalvagevalueR&DMarketingstudy$49,500,000$6,800,000$950,000$250,000 PriceVCFC$$$5752456,900,000 Price of old phone $435 Revised price of old phone $235 VC of old phone $155 Tax rate 21% NWC percentage 20% Required return 12% Output Area: Old phone price reduction $200 SalesLostsalesLostrev.NetsalesNewYear1(13,000,000,000)(13,000,000)$65,950,000Year2$97,750,000(7,000,000)$77,700,000Year4Year3$74,750,000$74,750,000Year5$60,375,000$60,375,000$46,000,000$46,000,000 VC \begin{tabular}{lccccc} New & $39,200,000 & $41,650,000 & $31,850,000 & $25,725,000 & $19,600,000 \\ Lost sales & (4,650,000) & (4,650,000) & & & \\ \cline { 2 - 6 } & $34,550,000 & $37,000,000 & $31,850,000 & $25,725,000 & $19,600,000 \end{tabular} \begin{tabular}{lrrrrr} Sales & $65,950,000 & $77,700,000 & $74,750,000 & $60,375,000 & $46,000,000 \\ VC & 34,550,000 & 37,000,000 & 31,850,000 & 25,725,000 & 19,600,000 \\ Fixed costs & 6,900,000 & 6,900,000 & 6,900,000 & 6,900,000 & 6,900,000 \\ Dep & 7,073,550 & 12,122,550 & 8,657,550 & 6,182,550 & 4,420,350 \\ EBT & $17,426,450 & $21,677,450 & $27,342,450 & $21,567,450 & $15,079,650 \\ Tax & 3,659,555 & 4,552,265 & 5,741,915 & 4,529,165 & 3,166,727 \\ \hline NI & $13,766,896 & $17,125,186 & $21,600,536 & $17,038,286 & $11,912,924 \\ +Dep & 7,073,550 & 12,122,550 & 8,657,550 & 6,182,550 & 4,420,350 \\ OCF & $20,840,446 & $29,247,736 & $30,258,086 & $23,220,836 & $16,333,274 \end{tabular} NWC Beg End NWC CF \begin{tabular}{rrcrr} 13,190,000 & 15,540,000 & 14,950,000 & 12,075,000 & 0 \\ \hline($13,190,000) & ($2,350,000) & $590,000 & $2,875,000 & $12,075,000 \end{tabular} Net CF $7,650,446$26,897,736$30,848,086$26,095,836$28,408,274 Salvage BV of equipment $11,043,450

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts