Question: The Austen Company uses an absorption - costing system based on standard costs. Variable manufacturing cost consists of direct material cost of $ 3 .

The Austen Company uses an absorptioncosting system based on standard costs. Variable manufacturing cost consists of direct material cost of $ per unit and other variable manufacturing costs of $ per unit. The standard production rate is units per machinehour. Total budgeted and actual fixed manufacturing overhead costs are $ Fixed manufacturing overhead is allocated at $ per machinehour based on fixed manufacturing costs of $ : comma machinehours, which is the level Austen uses as its denominator level. The selling price is $ per unit. Variable operatingnonmanufacturing cost which is driven by units sold, is $ per unit. Fixed operatingnonmanufacturing costs are $ comma Beginning inventory in is units; ending inventory is comma units. Sales in are units. The same standard unit costs persisted throughout and For simplicity, assume that there are no price, spending, or efficiency variances.

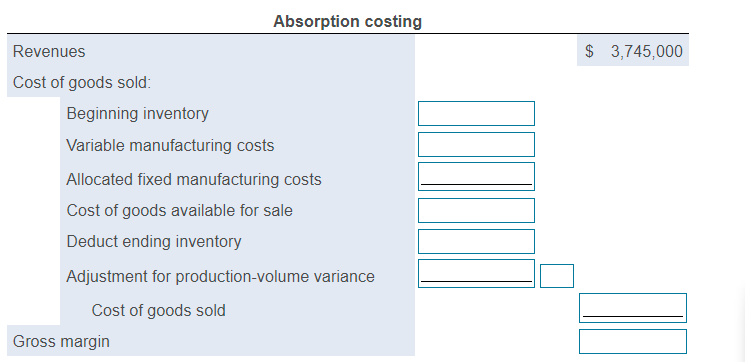

Requirement Prepare an income statement for assuming that the productionvolume variance is written off at yearend as an adjustment to cost of goods sold.

Complete the top half of the income statement first, then complete the bottom portion. Label the variance as favorableF or unfavorableU

Requirement The president has heard about variable costing. She asks you to recast the statement as it would appear under variable costing.

Another term for a variable costing income statement is a contribution margin income statement. Recall that Contribution Margin Revenues Variable Costs. Therefore the top half of the statement will be the revenue and variable cost accounts.

Complete the top half of the income statement. The variable costing income statement lists variable costs separate from fixed costs, therefore, in the cost of goods sold section, we need to compute the beginning and ending inventory amounts only using variable costs. Amounts that do not change between different types of income statements have been entered in for you.

Absorption costing

Gross margin

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock