Question: The balance sheet for OUS Corp is shown below. The bonds are currently selling at 97.5% of par. There are 500 shares of preferred stock

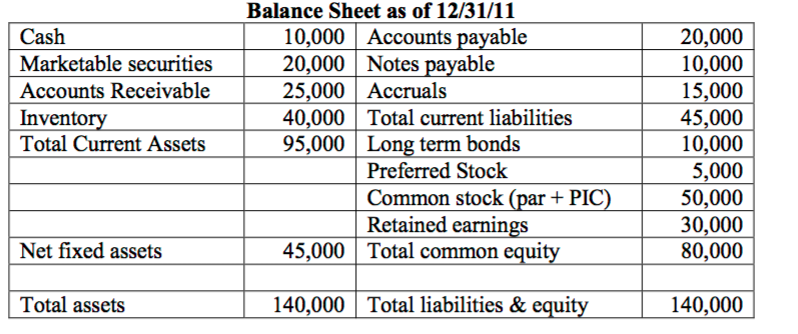

The balance sheet for OUS Corp is shown below. The bonds are currently selling at 97.5% of par. There are 500 shares of preferred stock outstanding and it has a current market price of $11.20. There are 6,000 shares of common stock outstanding and the latest quote was $32.35. What is the best estimate for the weights to be used when calculating the WACC?

Balance Sheet as of 12/31/11 20,000 Cash 10,000 Accounts payable 10,000 Marketable securities 20,000 Notes payable Accounts Receivable 25,000 Accruals 15,000 40,000 Total current liabilities 45,000 Inventory Total Current Assets 95,000 Long term bonds 10,000 5,000 Preferred Stock Common stock (par PIC) 50,000 30,000 Retained earnings Net fixed assets 80,000 45,000 Total common equity Total assets 140,000 Total liabilities & equity 140,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts