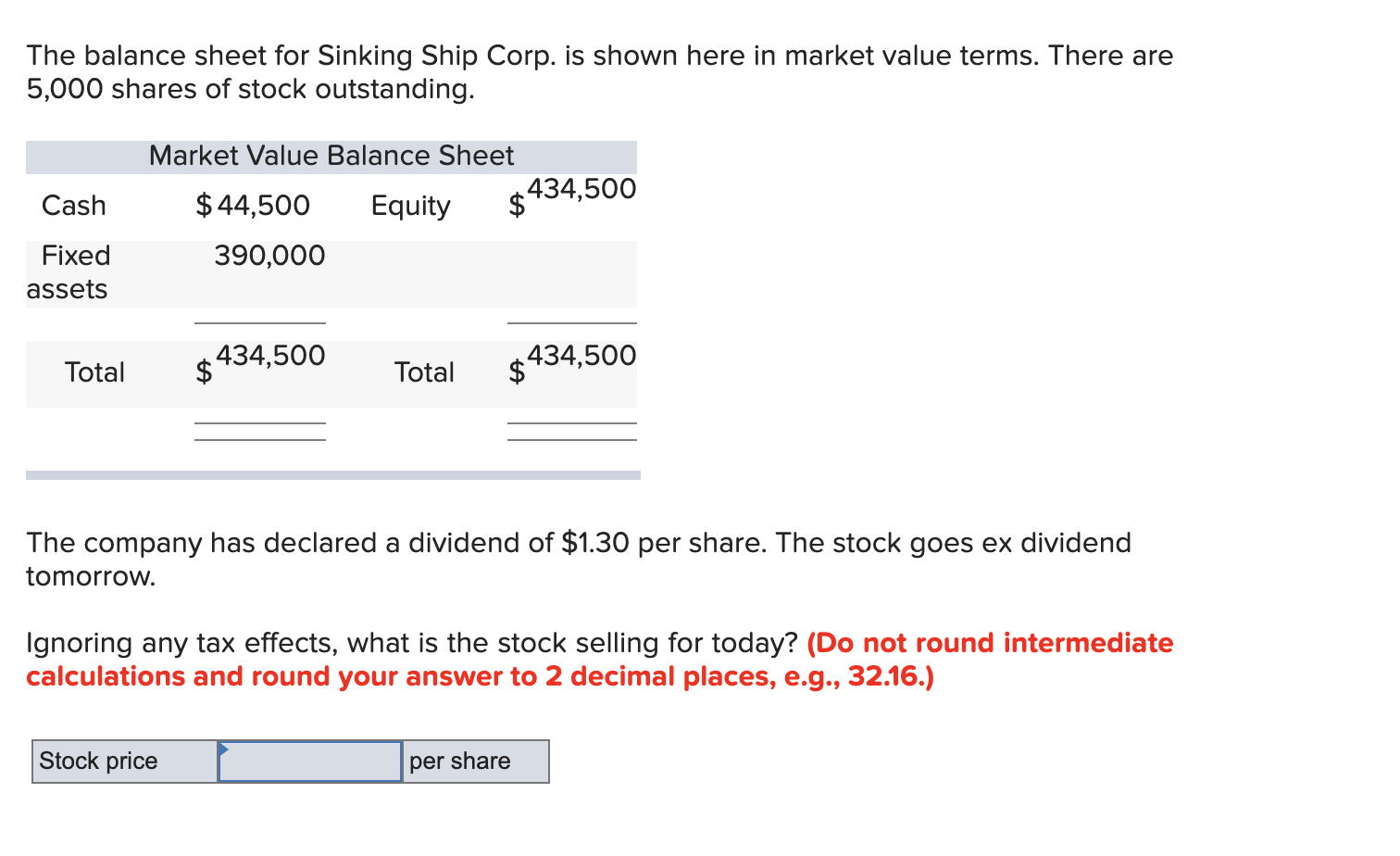

Question: The balance sheet for Sinking Ship Corp. is shown here in market value terms. There are 5,000 shares of stock outstanding. Market Value Balance Sheet

| The balance sheet for Sinking Ship Corp. is shown here in market value terms. There are 5,000 shares of stock outstanding. |

| Market Value Balance Sheet | ||||||

| Cash | $ | 44,500 | Equity | $ | 434,500 | |

| Fixed assets | 390,000 | |||||

| Total | $ | 434,500 | Total | $ | 434,500 | |

| The company has declared a dividend of $1.30 per share. The stock goes ex dividend tomorrow. |

| Ignoring any tax effects, what is the stock selling for today? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) |

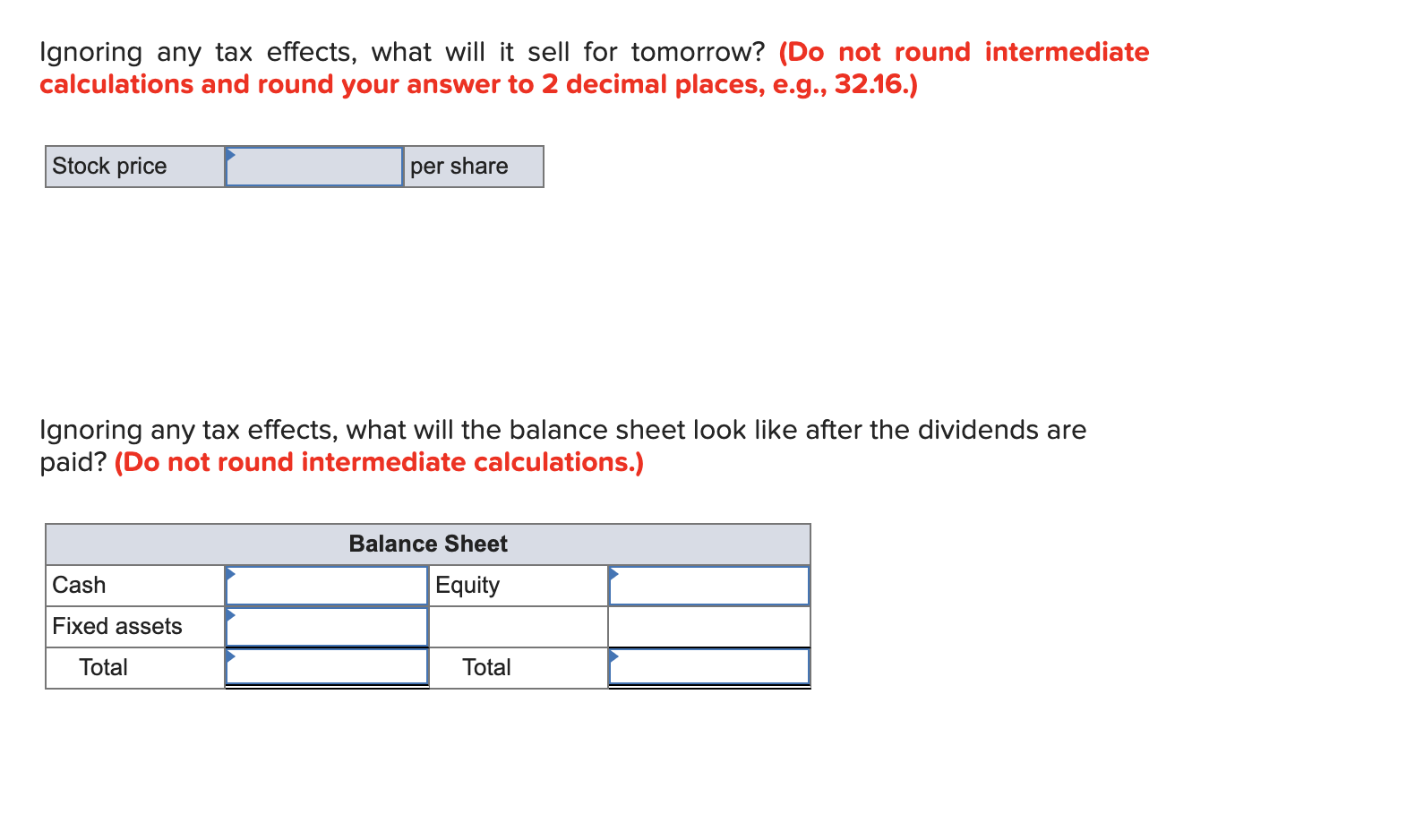

| Ignoring any tax effects, what will it sell for tomorrow? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) |

| Ignoring any tax effects, what will the balance sheet look like after the dividends are paid? (Do not round intermediate calculations.) |

The balance sheet for Sinking Ship Corp. is shown here in market value terms. There are 5,000 shares of stock outstanding. Cash Market Value Balance Sheet 434,500 $ 44,500 Equity 390,000 Fixed assets Total 434,500 $434,500 Total The company has declared a dividend of $1.30 per share. The stock goes ex dividend tomorrow. Ignoring any tax effects, what is the stock selling for today? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Stock price per share Ignoring any tax effects, what will it sell for tomorrow? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Stock price per share Ignoring any tax effects, what will the balance sheet look like after the dividends are paid? (Do not round intermediate calculations.) Balance Sheet Cash Equity Fixed assets Total Total

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts