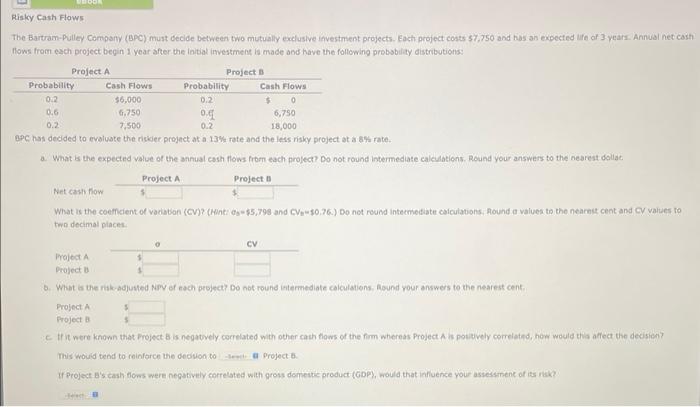

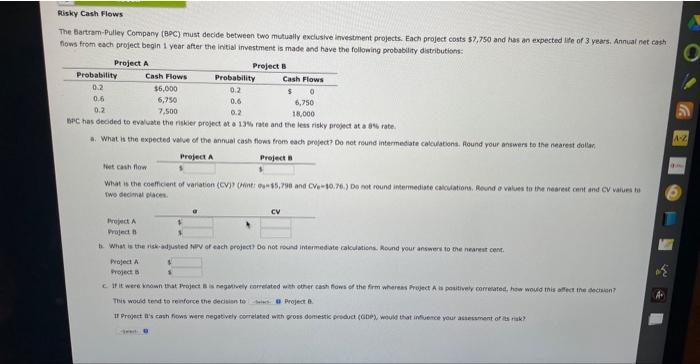

Question: The Bartram-Puiley Company (BPC) must decide between two mutually exclusive investntent projects. Fach project costs 57,750 and has an expected iff of 3 yeals. Annual

The Bartram-Puiley Company (BPC) must decide between two mutually exclusive investntent projects. Fach project costs 57,750 and has an expected iff of 3 yeals. Annual net cash flows from each project begin i year after the initial imvestment is made and thave the following probsbility distributions: BPC nas dedded to evaluate the riskier preject at a 13% rete and the less risky project at a sow rate. a. What is the expected value of the annusl cash flows from each project Do not round intermediate calculations. Round your answers to the nearest dollat two decimal places. b. What as the ritk-adjusted Niny of each project? Do not round istermediate calculations. foonst your answers to the nearest cent. Project A Project B c. If it were known that Project B is negatively correlated with other cath fows of the fim whereas Project a is potively correlatid, how would this affect the decisten? This would tend to reinforce the decison to Project 8. If Prolect B's cash flows were negatively correlated with gross domestic product (CDP), would that influence your assessmenc of is nak? The Bartram-Pulley Company (8eC) must decide between two mutually exclushe imvestment projects. Each project costs 57,750 and has an expected life of 3 years, Annual net cash fows from esch project begin 1 year after the initial investment is made and have the following probsbility dstributises:: 4. What is the expected vesue of the annuel cash flows from each project oo net round intermecate catcilatiens. foound your answers to the nearent dollar; two decital places. h. What is the nisk. adjusted hily of each project bo not rownd intermedate rakulations. Rownd vour answer to the neareat cent. Project A hroect 8 Trie would tend to reirforce the decikien to Projeat A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts