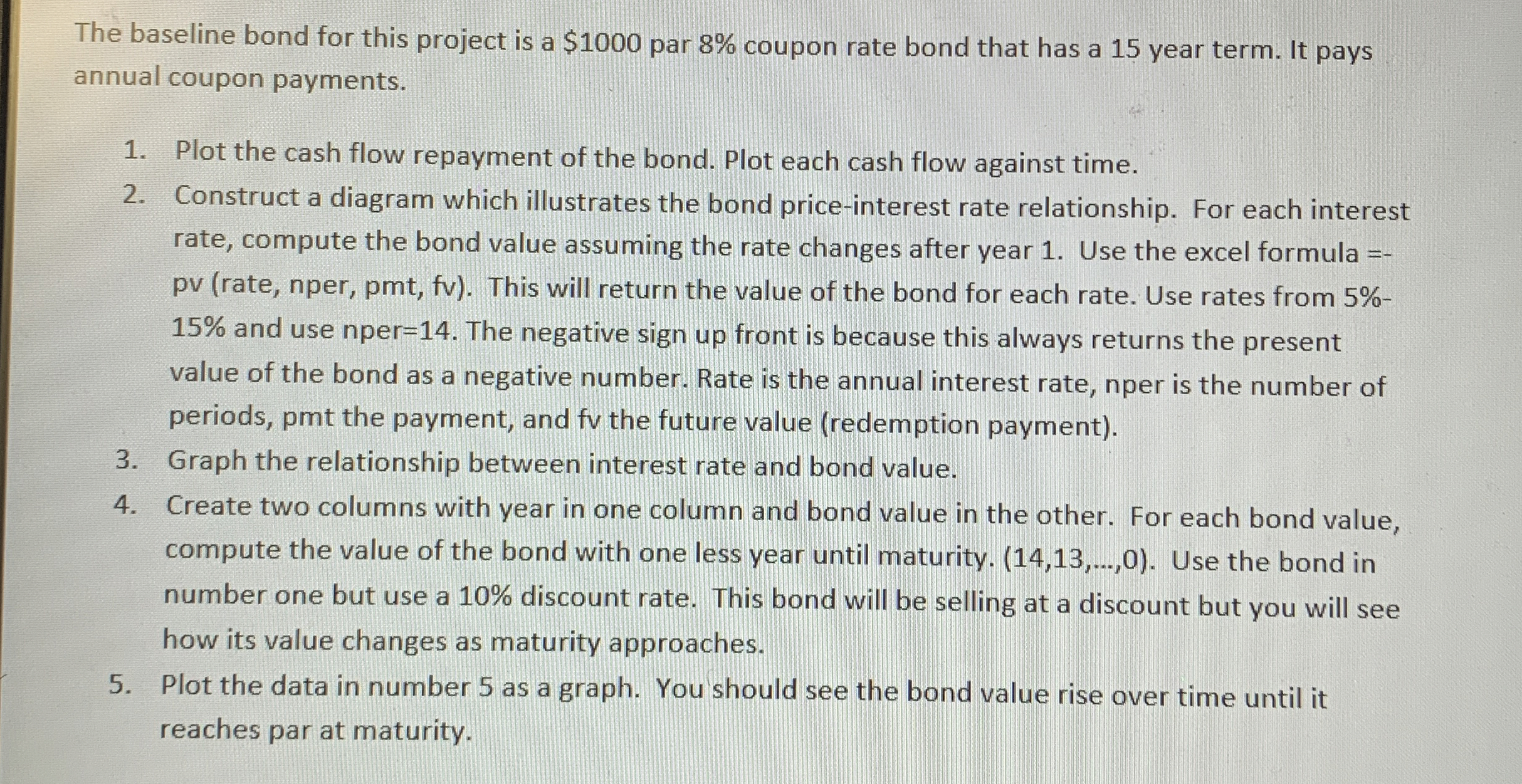

Question: The baseline bond for this project is a $ 1 0 0 0 par 8 % coupon rate bond that has a 1 5 year

The baseline bond for this project is a $ par coupon rate bond that has a year term. It pays annual coupon payments.

Plot the cash flow repayment of the bond. Plot each cash flow against time.

Construct a diagram which illustrates the bond priceinterest rate relationship. For each interest rate, compute the bond value assuming the rate changes after year Use the excel formula pv rate nper, pmt fv This will return the value of the bond for each rate. Use rates from and use nper The negative sign up front is because this always returns the present value of the bond as a negative number. Rate is the annual interest rate, nper is the number of periods, pmt the payment, and fv the future value redemption payment

Graph the relationship between interest rate and bond value.

Create two columns with year in one column and bond value in the other. For each bond value, compute the value of the bond with one less year until maturity. dots, Use the bond in number one but use a discount rate. This bond will be selling at a discount but you will see how its value changes as maturity approaches.

Plot the data in number as a graph. You should see the bond value rise over time until it reaches par at maturity.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock