Question: The basic adjusting entry will affect one Expense account and one Asset account. We will DEBIT the Expense account and CREDIT the Asset account. Note:

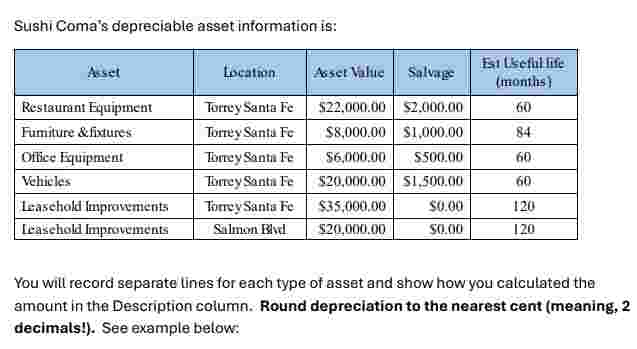

The basic adjusting entry will affect one Expense account and one Asset account. We will DEBIT the Expense account and CREDIT the Asset account. Note: we will not be paying cash for these expenses so never use a bank or cash account in this entry. For Sushi Coma, we will need to record onemonth of depreciation expense for all the fixed assets. Sushi Coma will use straightline depreciation. The formula to calulate MONTHLY depreciation will be: Asset Cost Salvage ValueUseful Life In months Enter an adjusting journal entry New, Journal Entry use reference AJE Depreciation to record monthly depreciation dated The class for each line will be Admin Sushi Coma's depreciable asset information is: You will record separate lines for each type of asset and show how you catculated the amount in the Description column. Round depreciation to the nearest cent meaning decimats! See example below:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock