Question: The basic assumptions of CAPM methodology You are the managing partner at a venture capital firm, and you feel that to solidify your status as

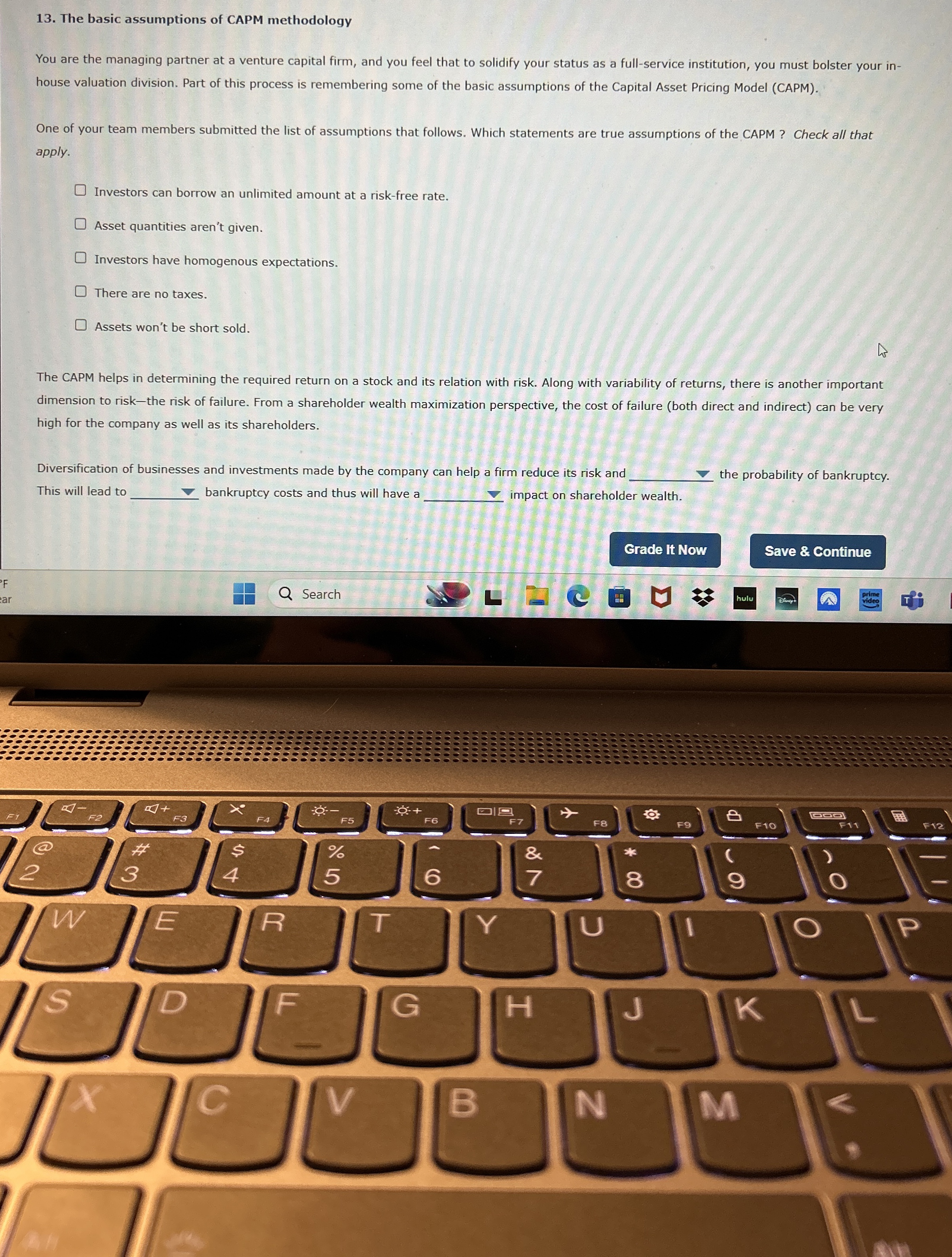

The basic assumptions of CAPM methodology

You are the managing partner at a venture capital firm, and you feel that to solidify your status as a fullservice institution, you must bolster your in

house valuation division. Part of this process is remembering some of the basic assumptions of the Capital Asset Pricing Model CAPM

One of your team members submitted the list of assumptions that follows. Which statements are true assumptions of the CAPM Check all that

apply.

Investors can borrow an unlimited amount at a riskfree rate.

Asset quantities aren't given.

Investors have homogenous expectations.

There are no taxes.

Assets won't be short sold.

The CAPM helps in determining the required return on a stock and its relation with risk. Along with variability of returns, there is another important

dimension to riskthe risk of failure. From a shareholder wealth maximization perspective, the cost of failure both direct and indirect can be very

high for the company as well as its shareholders.

Diversification of businesses and investments made by the company can help a firm reduce its risk and

the probability of bankruptcy.

This will lead tc

bankruptcy costs and thus will have a

impact on shareholder wealth.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock