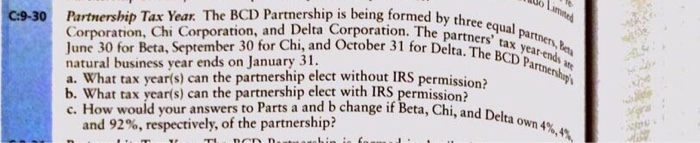

Question: The BCD Partnership is being formed by three equal partners Corporation, Chi Corporation and Delta Corporation. The partners' tax year-ends are June 30 for Beta,

The BCD Partnership is being formed by three equal partners Corporation, Chi Corporation and Delta Corporation. The partners' tax year-ends are June 30 for Beta, September 30 for Chi and October 31 for Delta. The BCD Partnership natural business year ends on January 31. What tax tear(s) can the partnership elect without IRS permission? What tax tear(s) can the partnership elect with IRS permission? How would your answers to Parts a and b change if Beta Chi and Delta own 4 % 4% and 92 % respectively of the partnership

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock