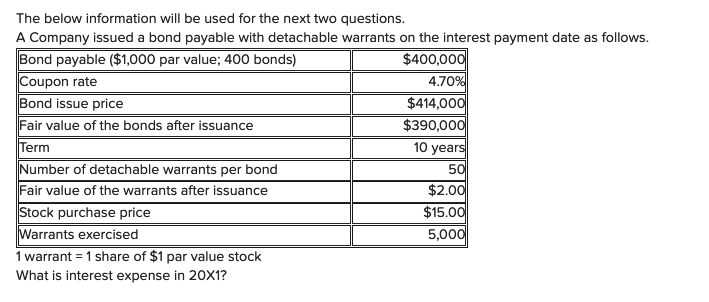

Question: The below information will be used for the next two questions. A Company issued a bond payable with detachable warrants on the interest payment date

The below information will be used for the next two questions. A Company issued a bond payable with detachable warrants on the interest payment date as follows. Bond payable ($1,000 par value; 400 bonds) $400,000 Coupon rate 4.70% Bond issue price $414,000 Fair value of the bonds after issuance $390,000 Term 10 years Number of detachable warrants per bond Fair value of the warrants after issuance $2.00 Stock purchase price $15.00 Warrants exercised I 5,000 1 warrant = 1 share of $1 par value stock What is interest expense in 20X1? 50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts