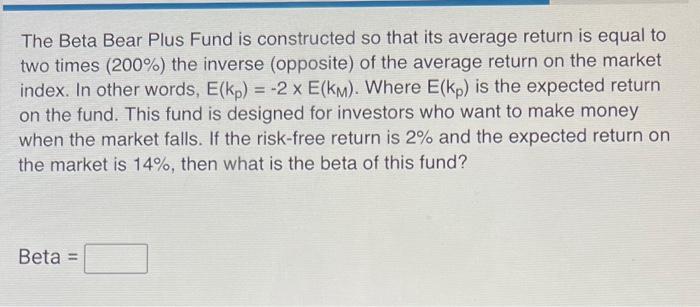

Question: The Beta Bear Plus Fund is constructed so that its average return is equal to two times (200%) the inverse (opposite) of the average return

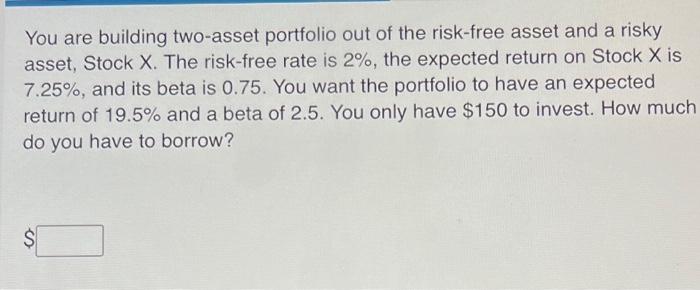

The Beta Bear Plus Fund is constructed so that its average return is equal to two times (200%) the inverse (opposite) of the average return on the market index. In other words, E(kp) = -2 x E(km). Where E(kp) is the expected return on the fund. This fund is designed for investors who want to make money when the market falls. If the risk-free return is 2% and the expected return on the market is 14%, then what is the beta of this fund? Beta = You are building two-asset portfolio out of the risk-free asset and a risky asset, Stock X. The risk-free rate is 2%, the expected return on Stock X is 7.25%, and its beta is 0.75. You want the portfolio to have an expected return of 19.5% and a beta of 2.5. You only have $150 to invest. How much do you have to borrow? $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts