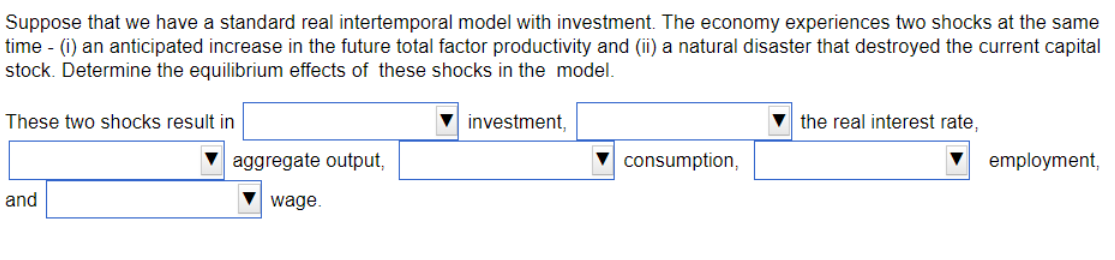

Question: The blank are increase, decrease, no change, or ambiguous in change lntertemporal substitution of labour suggests that O A. in the short runI the substitution

The blank are increase, decrease, no change, or ambiguous in change

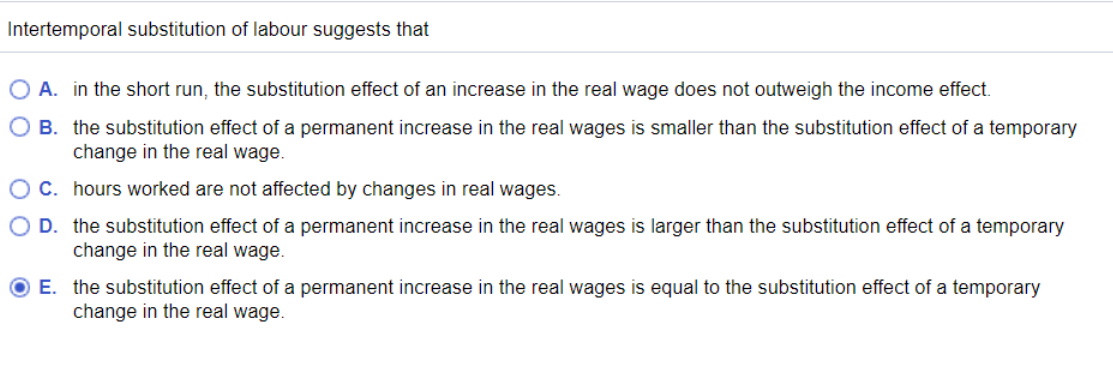

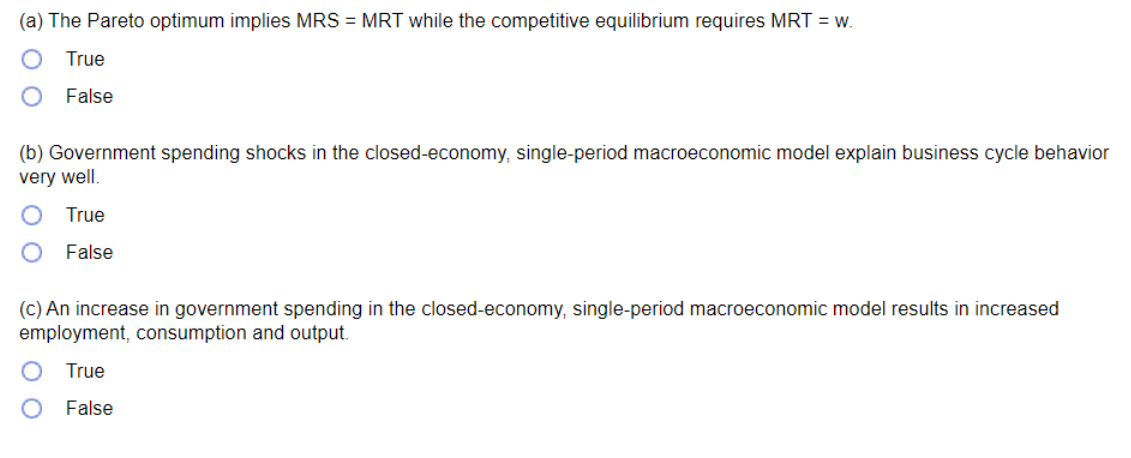

lntertemporal substitution of labour suggests that O A. in the short runI the substitution effect of an increase in the real wage does not outweigh the income effect. 0 B. the substitution effect of a permanent increase in the real wages is smaller than the substitution effect of a temporary change in the real wage. O C. hours worked are not affected by changes in real wages. O D. the substitution effect of a permanent increase in the real wages is larger than the substitution effect of a temporary change in the real wage. G) E. the substitution effect of a permanent increase in the real wages is equal to the substitution effect of a temporary change in the real wage. (a) The Pareto optimum implies MRS = MRT while the competitive equilibrium requires MRT = W. O True O False (b) Government spending shocks in the closed-economy, single-period macroeconomic model explain business cycle behavior very well. O True O False (c) An increase in government spending in the closed-economy, single-period macroeconomic model results in increased employment, consumption and output. O True O FalseSuppose that we have a standard real intertemporal model with investment. The economy experiences two shocks at the same time - (i) an anticipated increase in the future total factor productivity and (ii) a natural disaster that destroyed the current capital stock. Determine the equilibrium effects of these shocks in the model. These two shocks result in investment, the real interest rate, aggregate output, consumption, employment, and wage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts