Question: the blank ones i got it wrong Some recent financial statements for Earl Grey Golf Corp. follow Assets 2015 Current assets Cash Accounts receivable Inventory

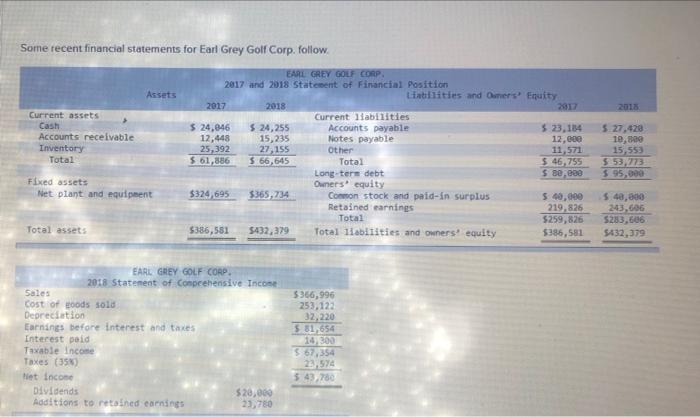

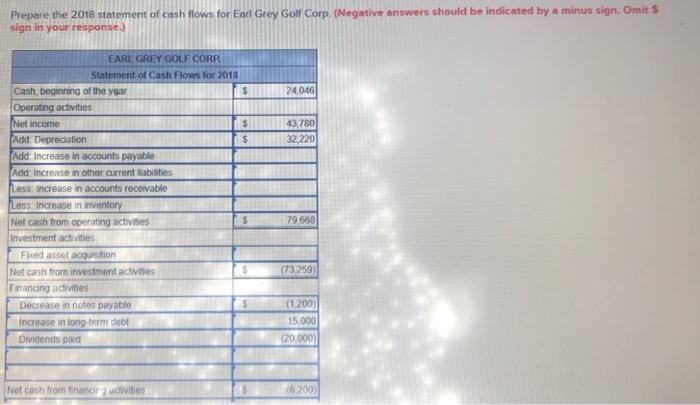

Some recent financial statements for Earl Grey Golf Corp. follow Assets 2015 Current assets Cash Accounts receivable Inventory Total EARL GREY GOLF CORP 2017 and 2018 Statement of Financial Position Libilities and Owners Enuity 2017 2018 2012 Current abilities $ 24,846 $ 24,255 Accounts payable $ 23,134 12,448 15,235 Notes payable 12,600 25,392 27, 155 Other 11 571 $ 61,886 5 66,645 Total $ 46.755 Long-tere debt $ 20,000 Owners equity $324,695 $365, 734 Common stock and paid-in surplus $ 40,000 Retained earnings 219,826 Total $259,826 $386,551 5432,379 Total liabilities and owners' equity $385,581 5. 27,428 10,89 15 553 55,773 5.95,000 Fixed assets Net plant and equipment 5.40,000 243,606 $283, 606 5432,379 Total assets EARL GREY GOLF CORP 2018 Statement of Compeehensive Income Sales Cost of goods sold Depreciation Earnings before interest and taxes Interest paid Taxable income Taxes (35) Net Incon Dividends $20,000 Additions to retained earnings 23,780 $366,996 253,122 32,220 5 31654 16,300 567,354 22,574 5.43.780 Prepare the 2018 statement of cash flows for Earl Grey Golf Corp. (Negative answers should be indicated by a minus sign. Omits sign in your response.) 24046 43780 32,220 EARI GREY GOLF CORR Statement of Cash Flows for 2018 Cash, beginning of the year $ Operating activities Net Income $ Add Depreciation $ Add. Increase in accounts payable Add: Increase in other current liabilities Less Increase in accounts receivable Less: Increase in inventory Net cash from operating activities Investment activities Fixed asset acquisition Net cash from investment activities $ Financing activities Decrease in notes payable Increase in long-term doo Dividends poid 79.668 173.259) (1200) 15 000 120.000) Net cash from financing udivities 16.200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts