Question: THE BLUE IS THE SOLUTIONS. PLEASE EXPLAIN WHY (OR EVEN REWRITE IT SO I CAN UNDERSTAND)/DU MB IT DOWN PLEASE. HAVING TROUBLE UNDERSTADING HOW THIS

THE BLUE IS THE SOLUTIONS. PLEASE EXPLAIN WHY (OR EVEN REWRITE IT SO I CAN UNDERSTAND)/DU MB IT DOWN PLEASE.

HAVING TROUBLE UNDERSTADING HOW THIS PROCESS WORK. THE SOLUTIONS ARE ALREADY PROVIDED. PLEASE EXPLAIN SO I CAN FOLLOW THROUGH

THE PROBLEM IS OVER HEDGING SUCH AS LONG AND SHORT CALLS AND CHARTS.

PAYOFF DIAGRAM

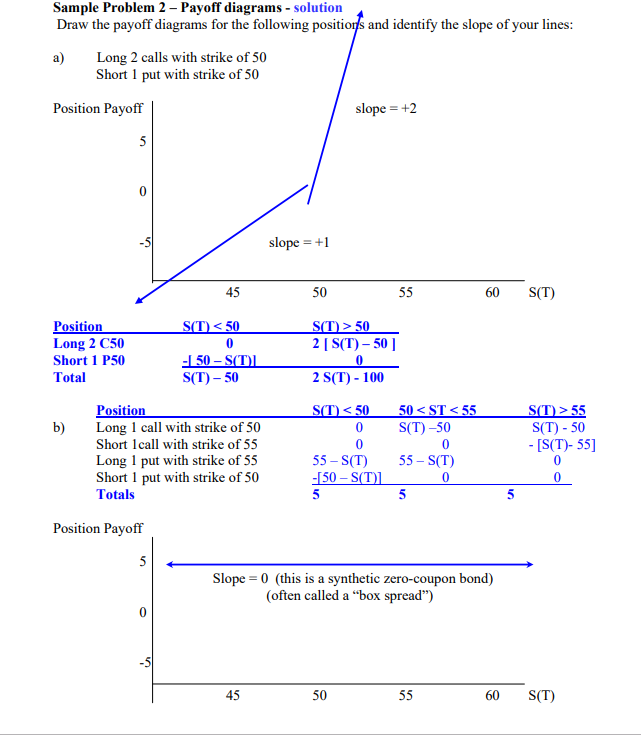

Sample Problem 2 - Payoff diagrams - solution Draw the payoff diagrams for the following positions and identify the slope of your lines: a) Long 2 calls with strike of 50 Short 1 put with strike of 50 Position Payoff slope = +2 slope = +1 50 55 60 S(T) S(T) 50 2 [S(T)- 50 ] - 50 -S(T) S(T) - 50 2 S(T) - 100 S(T) 55 S(T) - 50 - [S(T)-55] Position Long 1 call with strike of 50 Short Icall with strike of 55 Long 1 put with strike of 55 Short 1 put with strike of 50 Totals 55 -S(T) -50-S(T) 55-S(T) 0 Position Payoff Slope = 0 (this is a synthetic zero-coupon bond) (often called a "box spread") 45 50 55 60 S(T) Sample Problem 2 - Payoff diagrams - solution Draw the payoff diagrams for the following positions and identify the slope of your lines: a) Long 2 calls with strike of 50 Short 1 put with strike of 50 Position Payoff slope = +2 slope = +1 50 55 60 S(T) S(T) 50 2 [S(T)- 50 ] - 50 -S(T) S(T) - 50 2 S(T) - 100 S(T) 55 S(T) - 50 - [S(T)-55] Position Long 1 call with strike of 50 Short Icall with strike of 55 Long 1 put with strike of 55 Short 1 put with strike of 50 Totals 55 -S(T) -50-S(T) 55-S(T) 0 Position Payoff Slope = 0 (this is a synthetic zero-coupon bond) (often called a "box spread") 45 50 55 60 S(T)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts