Question: The blue question, please! using the data from the first picture 37 38 39 40 1) Stand-alone return and risk: Compute the data for each

The blue question, please! using the data from the first picture

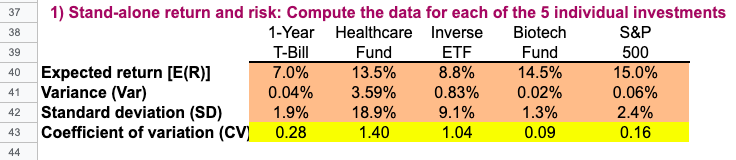

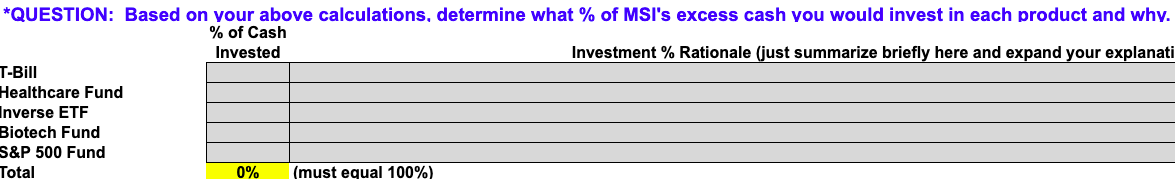

37 38 39 40 1) Stand-alone return and risk: Compute the data for each of the 5 individual investments 1-Year Healthcare Inverse Biotech S&P T-Bill Fund ETF Fund 500 Expected return [E(R)] 7.0% 13.5% 8.8% 14.5% 15.0% Variance (Var) 0.04% 3.59% 0.83% 0.02% 0.06% Standard deviation (SD) 1.9% 18.9% 9.1% 1.3% 2.4% Coefficient of variation (CV) 0.28 1.40 1.04 0.09 0.16 41 42 43 44 *QUESTION: Based on your above calculations, determine what % of MSI's excess cash you would invest in each product and why. % of Cash Invested Investment % Rationale (just summarize briefly here and expand your explanati T-Bill Healthcare Fund Inverse ETF Biotech Fund S&P 500 Fund Total 0% (must equal 100%) 37 38 39 40 1) Stand-alone return and risk: Compute the data for each of the 5 individual investments 1-Year Healthcare Inverse Biotech S&P T-Bill Fund ETF Fund 500 Expected return [E(R)] 7.0% 13.5% 8.8% 14.5% 15.0% Variance (Var) 0.04% 3.59% 0.83% 0.02% 0.06% Standard deviation (SD) 1.9% 18.9% 9.1% 1.3% 2.4% Coefficient of variation (CV) 0.28 1.40 1.04 0.09 0.16 41 42 43 44 *QUESTION: Based on your above calculations, determine what % of MSI's excess cash you would invest in each product and why. % of Cash Invested Investment % Rationale (just summarize briefly here and expand your explanati T-Bill Healthcare Fund Inverse ETF Biotech Fund S&P 500 Fund Total 0% (must equal 100%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts