Question: THE BOOK CONTRACT General Briefing Notes A young writer ( William P . Johnston ) has produced a manuscript that has drawn serious interest from

THE BOOK CONTRACT

General Briefing Notes

A young writer William P Johnston has produced a manuscript that has drawn serious interest

from several publishing houses. How should one of these publishers craft an offer that will be

most attractive to the author, without sacrificing its own financial interests? Typical publishing

contracts provide authors two different forms of compensation and payment can be in advance

reduced rate, due to increased risk or after sales:

Royalties:

Royalties based on sales This is usually percent of the retail price for the first

books sold, percent for the next and percent thereafter.

Second Print Run This is a split between the publisher and the author sometimes

of any subsequent sale of reprint or paperback rights, if the book proves popular.

Payment:

Payment after sales is generally calculated quarterly: Mar. June Sept. Dec.

Advance against royalties This is a negotiated amount, payable upon contract signing.

The author is allowed to keep this amount even if subsequent sales do not yield the

expected royalties.

As a general matter, authors prefer to be paid more and paid sooner while publishers prefer

just the opposite. The negotiation takes place at the publishing house and will last minutes.

Confidential Notes for Reagent's

Reagent's Royal Publishers is a very wellknown publisher which is specialized in finding new,

young authors. You are very interested in having William P Johnston as an author. His work is

very good and, although he is a very young, new writer, you see a big market for his work.

Obviously, having him exclusively is a prerequisite for working together.

Since Johnston is an unknown author, you expect to be able to sell about books in the

first edition over a month period If the book really takes off, then you are willing to do a

second print run of for the nd edition. You recommend selling the book for You

expect to sell them evenly over the month period, so the royalty after sales would be paid out

evenly each quarter over the months. Sales are planned to begin in months.

Your internal company policy on a second print run is for you, for the author. As a rule,

agreement for the second print run is not finalized until after of the first print run is sold.

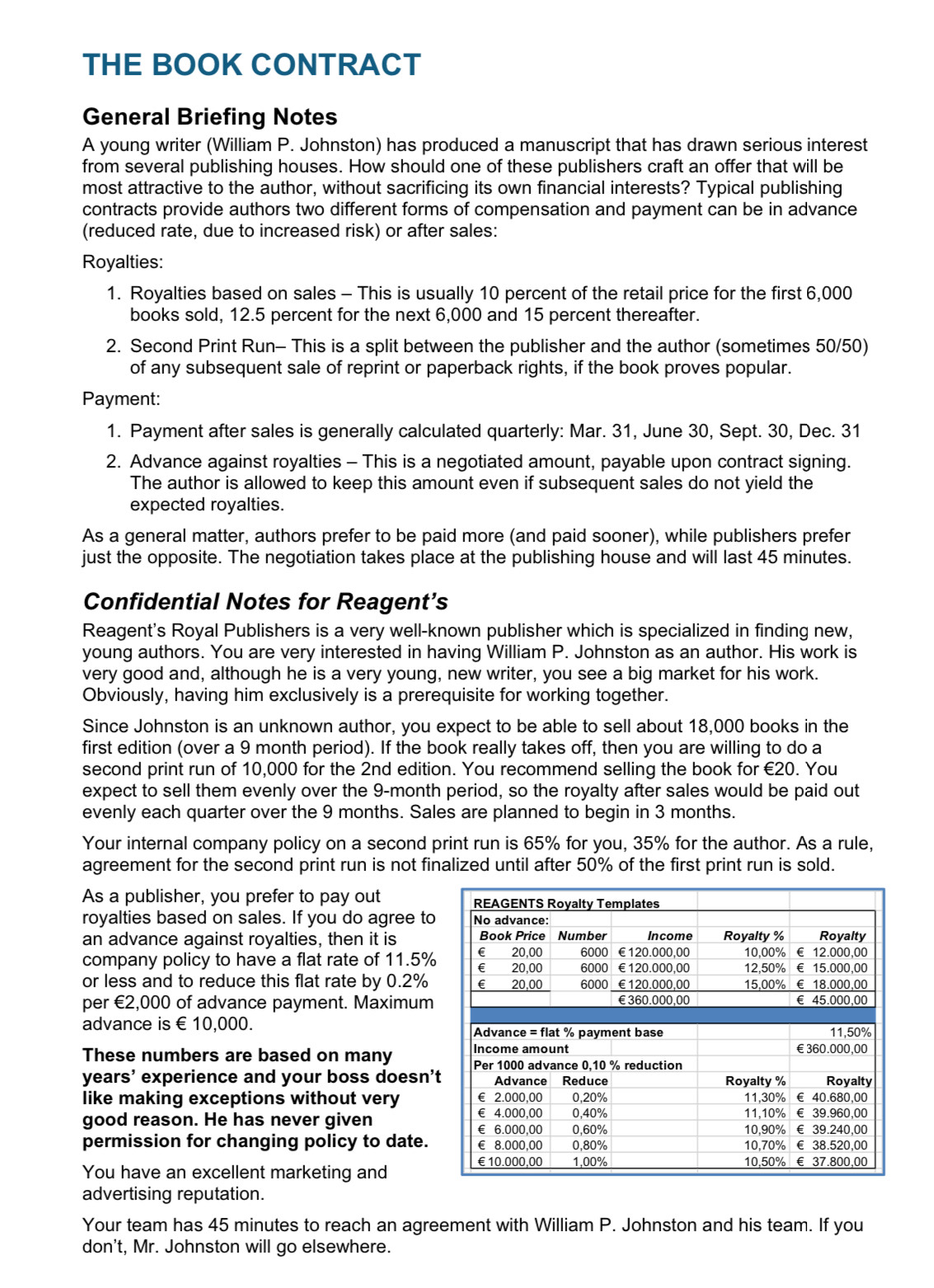

As a publisher, you prefer to pay out

royalties based on sales. If you do agree to

an advance against royalties, then it is

company policy to have a flat rate of

or less and to reduce this flat rate by

per of advance payment. Maximum

advance is

These numbers are based on many

years' experience and your boss doesn't

like making exceptions without very

good reason. He has never given

permission for changing policy to date.

You have an excellent marketing and

advertising reputation.

Your team has minutes to reach an agreement with William P Johnston and his team. If you

don't, Mr Johnston will go elsewhere. Overall negotiation outcome:

Agenda

Write down the key issues you wish to negotiate in the

form of an agenda which you will share with the other

party at the beginning of the negotiation.

Please list your issues according to your priority. You

do not need to fill in all issues.

Issue :

Issue :

Issue :

Issue :

Issue :

Issue :

Issue :Fill out the HIT list document, using the information given about the book contract.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock