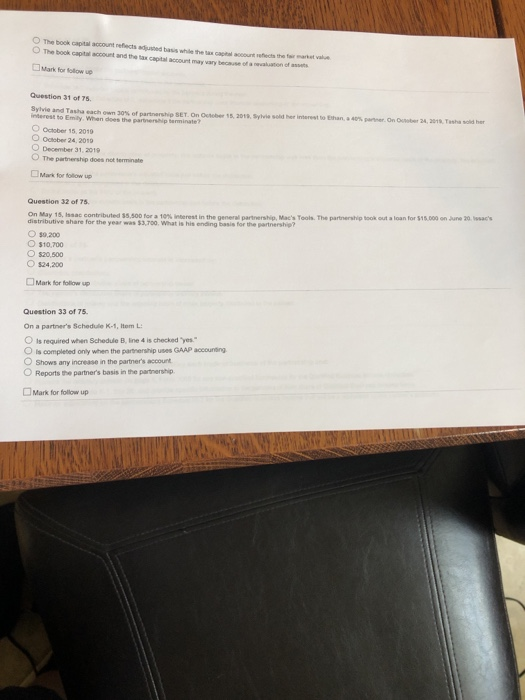

Question: The book w The book c o a s while the account is the ntact cu may vary because of Mark for Question 3 of

The book w The book c o a s while the account is the ntact cu may vary because of Mark for Question 3 of 75 Sylvie and Tasha each own 30% of partners SET On October 15, 2018 Sylvie rest to Emily. Wrandes the par a milie October 18 2010 October 24, 2010 December 31, 2019 The partnership does not terminate Mark for foow up Question 32 of 75 On May 15, Issac contributed 55.500 for a 10% interest in the general partnership, Mae's Tools. The part distributive share for the year w 53.700. What is his ending basis for the partnership? 50.200 O $10,700 O $20,500 O $24.200 Mark for follow up Question 33 of 75. On a partner's Schedule K-1,Hem L is required when Schedule Bline 4 is checked yes is completed only when the partnership uses GAP accounting O Shows any increase in the partner's account O Reports the partner's basis in the partnership Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts