Question: THE BOOK WE ARE USING IS BELOW CAN U HELP ME WITH QUESTION , THE SOFTWARE WE USE IS RSTUDIO The third option is to

THE BOOK WE ARE USING IS BELOW

CAN U HELP ME WITH QUESTION , THE SOFTWARE WE USE IS RSTUDIO

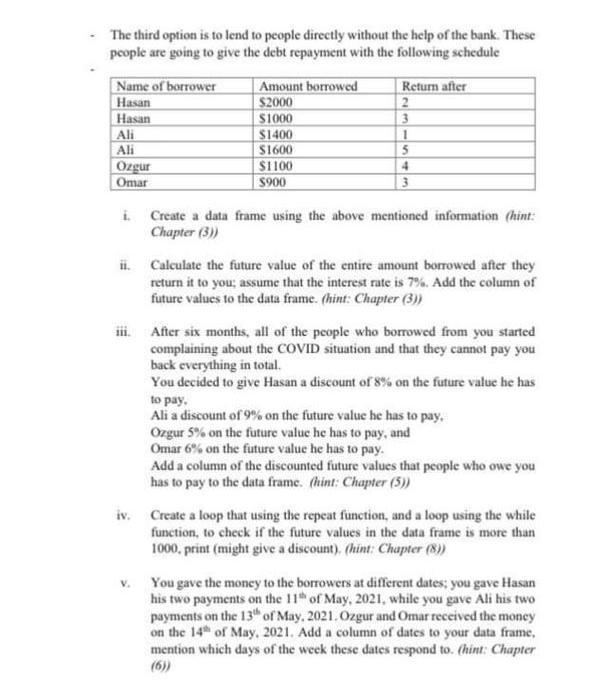

The third option is to lend to people directly without the help of the bank. These people are going to give the debt repayment with the following schedule Name of borrower Hasan Hasan Ali Ali Ozgur Omar Amount borrowed $2000 $1000 $1400 S1600 $1100 5900 Retum after 2 3 1 5 4 3 i Create a data frame using the above mentioned information (hint: Chapter (3) i. Calculate the future value of the entire amount borrowed after they return it to you; assume that the interest rate is 7%. Add the column of future values to the data frame. (hint: Chapter 3)) ii. After six months, all of the people who borrowed from you started complaining about the COVID situation and that they cannot pay you back everything in total You decided to give Hasan a discount of 8% on the future value he has to pay Ali a discount of 9% on the future value he has to pay. Ozgur 5% on the future value he has to pay, and Omar 6% on the future value he has to pay. Add a column of the discounted future values that people who owe you has to pay to the data frame. (hint: Chapter (5)) iv. Create a loop that using the repeat function, and a loop using the while function, to check if the future values in the data frame is more than 1000. print (might give a discount), (hint: Chapter (8) You gave the money to the borrowers at different dates; you gave Hasan his two payments on the 11" of May, 2021, while you gave Ali his two payments on the 13h of May, 2021. Ozgur and Omar received the money on the 14 of May, 2021. Add a column of dates to your data frame, mention which days of the week these dates respond to. (hint: Chapter TEXTBOOK/S 1. Venables, W. N., Smith, D. M., & R Development Core Team. (2009). An introduction to R. 2. Hafner, S. & Ryan, A. (2019). An Introduction to R for Beginners INDICATIVE BASIC READING LIST None EXTENDED READING LIST None The third option is to lend to people directly without the help of the bank. These people are going to give the debt repayment with the following schedule Name of borrower Hasan Hasan Ali Ali Ozgur Omar Amount borrowed $2000 $1000 $1400 S1600 $1100 5900 Retum after 2 3 1 5 4 3 i Create a data frame using the above mentioned information (hint: Chapter (3) i. Calculate the future value of the entire amount borrowed after they return it to you; assume that the interest rate is 7%. Add the column of future values to the data frame. (hint: Chapter 3)) ii. After six months, all of the people who borrowed from you started complaining about the COVID situation and that they cannot pay you back everything in total You decided to give Hasan a discount of 8% on the future value he has to pay Ali a discount of 9% on the future value he has to pay. Ozgur 5% on the future value he has to pay, and Omar 6% on the future value he has to pay. Add a column of the discounted future values that people who owe you has to pay to the data frame. (hint: Chapter (5)) iv. Create a loop that using the repeat function, and a loop using the while function, to check if the future values in the data frame is more than 1000. print (might give a discount), (hint: Chapter (8) You gave the money to the borrowers at different dates; you gave Hasan his two payments on the 11" of May, 2021, while you gave Ali his two payments on the 13h of May, 2021. Ozgur and Omar received the money on the 14 of May, 2021. Add a column of dates to your data frame, mention which days of the week these dates respond to. (hint: Chapter TEXTBOOK/S 1. Venables, W. N., Smith, D. M., & R Development Core Team. (2009). An introduction to R. 2. Hafner, S. & Ryan, A. (2019). An Introduction to R for Beginners INDICATIVE BASIC READING LIST None EXTENDED READING LIST None

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts