Question: The bootstrap method involves: A. Working from long maturity instruments to shorter maturity instruments determining zero rates at each step B. Calculating the par yield

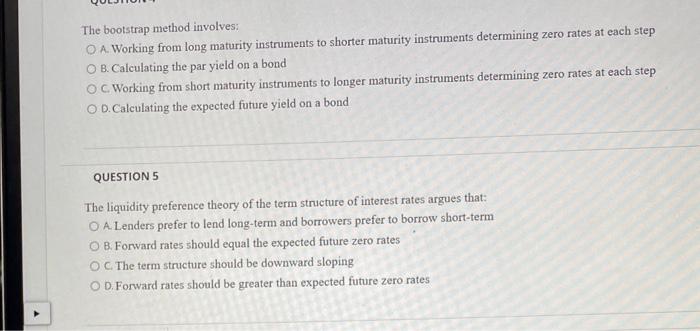

The bootstrap method involves: A. Working from long maturity instruments to shorter maturity instruments determining zero rates at each step B. Calculating the par yield on a bond C. Working from short maturity instruments to longer maturity instruments determining zero rates at each step D. Calculating the expected future yield on a bond QUESTION 5 The liquidity preference theory of the term structure of interest rates argues that: A.Lenders prefer to lend long-term and borrowers prefer to borrow short-term B. Forward rates should equal the expected future zero rates C. The term structure should be downward sloping D. Forward rates should be greater than expected future zero rates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts