Question: The bottom excel sheet is what I've done so far. Really, I just want to see if this is correct, and also some help with

The bottom excel sheet is what I've done so far. Really, I just want to see if this is correct, and also some help with questions 4 and 5. Please do in excel with formulas so I can see what is going on! Thanks.

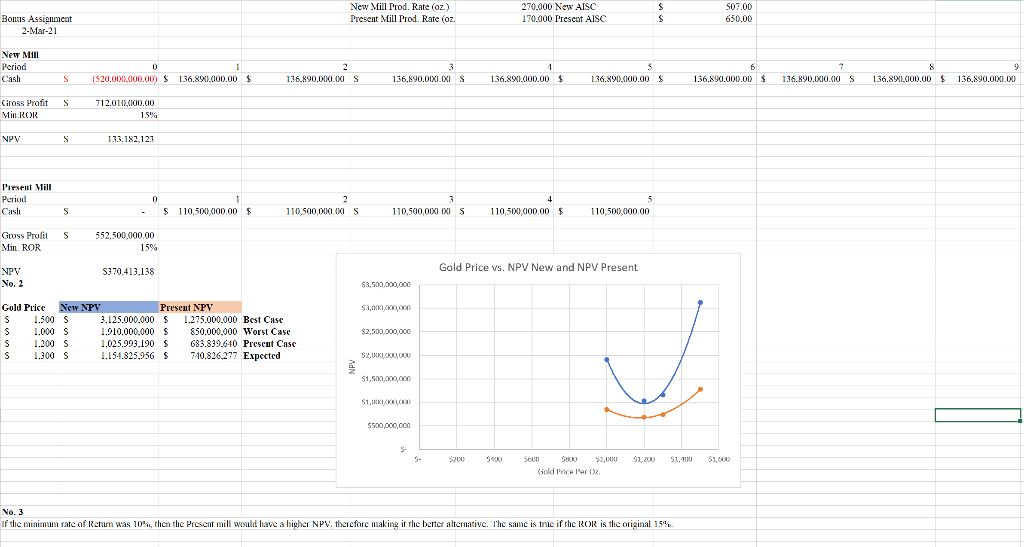

as presented in this article, You have just taken over as the CEO of Eldorado Gold. Do you build the New Mill as described in the article, or continue to use the Existing Mill for the remaining life of the mine? Here's some additional information and tips to help you make the decision: Use only the facts as reported in para. 2.1 & 2.2. - only look at the Kisladag Mine, and not the whole company, i.e. - Ignore para. 2.3, 2.4 & 2.5 Build 2 simple cash flow models, one for the New mill and one for the Existing Mill. 1. The Kisladag project is in Turkey, which has a higher than usual country risk, and the geology, processing & recovery also represents a higher than usual project risk. a. Therefore assume a Minimum rate of Return = to 15%. b. New Mill life 9 years, Capital Investment = $520 M in period 0, gold production as stated = 270,000 oz./ year, AISC= $793/oz. C. Existing Mill life 5 years, Capital Investment = $0, gold production as stated 170,000 oz./year, AISC= $650/oz. 2. Determine the NPV of both alternatives at the following gold prices Creat a graph of Gold Price vs. NPV. (Hint: with $0 capital investment for the Existing Mill, ROI is meaningless, however, you can calculate NPV) Remember DCFROR ? a. Best Case Gold = $1500 / oz. b. Worst Case Gold = $1000 / oz. c. Present Case Gold = $1200 / oz. d. The Company Expected Case Gold = $1300 / oz. What if a Minimum rate of Return = 10%. Does this change your decision? 3. 4. What must the gold price be to make the alternatives equal at: RADR=15%, o 5. RADR=10%? You are the CEO, what do you do? Justify your decision based on your analysis. 2. On the conference call George Burns, the CEO, was asked if the feasibility study for the new Kisladag development had analyzed if the project NPV of $434m had been compared to the NPV of just continuing with the present heap leach pad operation. The answer given was that there was no comparison needed, as the present operation would only last for another 2 years. My conclusion from this answer is that the comparison has definitely not been done. This seems to be a material omission in the planning stage. Let me explain. The new mill has a projected life span of 9 years at an average production rate of 270,000 ounces and AISC (all in sustaining costs) of $793. Assuming (as the company does for its feasibility study) a gold price of $1300 the gross profit from the operation is 270,000 x 9 x (1300-793) =1,232,010,000 less construction cost of $520,000,000 or $712,010,000. On the conference call it was revealed that the present operation had now been improved to produce a gold recovery rate of 60%. This has improved from 35-40% from the last quarter of 2017. It was also suggested that the company was presently not using the ore with the highest rates of gold, as these were being saved for the new development. So with lesser quality ore the company has now projected 160,000-170,000 ounces of gold at an AISC of $600-650 per ounce. This produces a gross profit (using mid prices) of 165,000 X (1300-625)=$111,375,000. Let us say, for arguments sake, that the present operation could be made to last for 5 more years and would be able to use the higher grade ore. This would produce a profit of 5 x 111,375,000 or $556,875,000. If this were so, the new operation spend of $520m was being risked for additional profit of $712,010,000- 556,875,000 or $155,135,000. This comparison makes the spend, which is stretching the company's balance sheet, seem rather risky. As this research has not been done the company may well be making an incorrect decision. New Mill Prod. Rate (oz.) Present Mill Prod. Rate (oz. 507.00 270.000 New AISC 170,000 Preseut AISC S S 650.00 Bonus Assignment 2-Mar-21 New MA Period Cash 0 1 1320.000.000.00) $136.890,000.00 $ 2 136,890,000.00 S 3 136,890.0IXI.XIS 1 136.890.000.00 $ $ 136.890,000.00 S 6 136.890.000.00 $ 2 136.890,0X10.00 S 8 136.890.000.00 $ S 136,890.000.00 Cross Profit S Min.KOR 712.010) .ICIO.00 1.5% NPV S 133.182,121 Present Mill Period Casli 0 0 2 110,500,000.00 3 110,500,000 s 4 110 500.000.00 S $ 110,500,000.00 $ 110,500,000.00 S Guss Profil Min ROR 552,500,000.00 15% S370,413.138 Gold Price vs. NPV New and NPV Present NPV No. 2 $3,500,000,000 $3,000,000,000 Gold Price New NPV Present NPV S 1.500 5 3.125.000.000 S 1.275.000.000 Best Case S 1.000 S 1.910.000.000 $ 850.000.000 Worst Case S 1.200 S 1.025.993,190 S 683.839.640 Prescut Case S 1.300 S 1.154.825,956 $ 740.826.277 Expected $2,500,000,000 $2,000,000 $ 4 $1,500,000,000 51,0000 $ $500,000,000 S- S. $200 $1,200 $1,100 $1,000 Si, 000 Gold PricePerU2 Price No. 3 If the minimum rate of Kchun was 10%, then the Present mill would have a higher NPV. therefore making it the better alternative. The same is true if the KOR is the original 15%. as presented in this article, You have just taken over as the CEO of Eldorado Gold. Do you build the New Mill as described in the article, or continue to use the Existing Mill for the remaining life of the mine? Here's some additional information and tips to help you make the decision: Use only the facts as reported in para. 2.1 & 2.2. - only look at the Kisladag Mine, and not the whole company, i.e. - Ignore para. 2.3, 2.4 & 2.5 Build 2 simple cash flow models, one for the New mill and one for the Existing Mill. 1. The Kisladag project is in Turkey, which has a higher than usual country risk, and the geology, processing & recovery also represents a higher than usual project risk. a. Therefore assume a Minimum rate of Return = to 15%. b. New Mill life 9 years, Capital Investment = $520 M in period 0, gold production as stated = 270,000 oz./ year, AISC= $793/oz. C. Existing Mill life 5 years, Capital Investment = $0, gold production as stated 170,000 oz./year, AISC= $650/oz. 2. Determine the NPV of both alternatives at the following gold prices Creat a graph of Gold Price vs. NPV. (Hint: with $0 capital investment for the Existing Mill, ROI is meaningless, however, you can calculate NPV) Remember DCFROR ? a. Best Case Gold = $1500 / oz. b. Worst Case Gold = $1000 / oz. c. Present Case Gold = $1200 / oz. d. The Company Expected Case Gold = $1300 / oz. What if a Minimum rate of Return = 10%. Does this change your decision? 3. 4. What must the gold price be to make the alternatives equal at: RADR=15%, o 5. RADR=10%? You are the CEO, what do you do? Justify your decision based on your analysis. 2. On the conference call George Burns, the CEO, was asked if the feasibility study for the new Kisladag development had analyzed if the project NPV of $434m had been compared to the NPV of just continuing with the present heap leach pad operation. The answer given was that there was no comparison needed, as the present operation would only last for another 2 years. My conclusion from this answer is that the comparison has definitely not been done. This seems to be a material omission in the planning stage. Let me explain. The new mill has a projected life span of 9 years at an average production rate of 270,000 ounces and AISC (all in sustaining costs) of $793. Assuming (as the company does for its feasibility study) a gold price of $1300 the gross profit from the operation is 270,000 x 9 x (1300-793) =1,232,010,000 less construction cost of $520,000,000 or $712,010,000. On the conference call it was revealed that the present operation had now been improved to produce a gold recovery rate of 60%. This has improved from 35-40% from the last quarter of 2017. It was also suggested that the company was presently not using the ore with the highest rates of gold, as these were being saved for the new development. So with lesser quality ore the company has now projected 160,000-170,000 ounces of gold at an AISC of $600-650 per ounce. This produces a gross profit (using mid prices) of 165,000 X (1300-625)=$111,375,000. Let us say, for arguments sake, that the present operation could be made to last for 5 more years and would be able to use the higher grade ore. This would produce a profit of 5 x 111,375,000 or $556,875,000. If this were so, the new operation spend of $520m was being risked for additional profit of $712,010,000- 556,875,000 or $155,135,000. This comparison makes the spend, which is stretching the company's balance sheet, seem rather risky. As this research has not been done the company may well be making an incorrect decision. New Mill Prod. Rate (oz.) Present Mill Prod. Rate (oz. 507.00 270.000 New AISC 170,000 Preseut AISC S S 650.00 Bonus Assignment 2-Mar-21 New MA Period Cash 0 1 1320.000.000.00) $136.890,000.00 $ 2 136,890,000.00 S 3 136,890.0IXI.XIS 1 136.890.000.00 $ $ 136.890,000.00 S 6 136.890.000.00 $ 2 136.890,0X10.00 S 8 136.890.000.00 $ S 136,890.000.00 Cross Profit S Min.KOR 712.010) .ICIO.00 1.5% NPV S 133.182,121 Present Mill Period Casli 0 0 2 110,500,000.00 3 110,500,000 s 4 110 500.000.00 S $ 110,500,000.00 $ 110,500,000.00 S Guss Profil Min ROR 552,500,000.00 15% S370,413.138 Gold Price vs. NPV New and NPV Present NPV No. 2 $3,500,000,000 $3,000,000,000 Gold Price New NPV Present NPV S 1.500 5 3.125.000.000 S 1.275.000.000 Best Case S 1.000 S 1.910.000.000 $ 850.000.000 Worst Case S 1.200 S 1.025.993,190 S 683.839.640 Prescut Case S 1.300 S 1.154.825,956 $ 740.826.277 Expected $2,500,000,000 $2,000,000 $ 4 $1,500,000,000 51,0000 $ $500,000,000 S- S. $200 $1,200 $1,100 $1,000 Si, 000 Gold PricePerU2 Price No. 3 If the minimum rate of Kchun was 10%, then the Present mill would have a higher NPV. therefore making it the better alternative. The same is true if the KOR is the original 15%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts